Italy is on sale… for a while

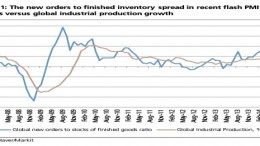

MADRID | The Corner | On July 1 the new Italian fiscal reform will begin and the tax rate on capital gains will go up from 20% to 26%. Both private and institutional investors are selling before that date so as to rebuy again after and get a +2% after tax return. The FTSEMIB stands below the levels recorded after Mr Renzi’s victory and at the same levels registered before Mr Draghi’s last intervention. The index is behaving worse than the Spanish Ibex 35, and –if this trend continues, next week will be the moment to resume positions.