Lowflation is not over

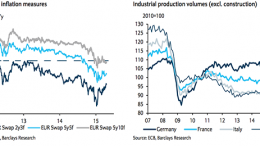

April 22, 2015 | BNP Paribas | There is further upside risks on global consumption, especially in lower-income EM countries and the Eurozone. However, we do not believe that global deleveraging has come to an end: wage growth and inflation will likely continue to trend low over the coming years.