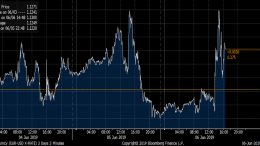

AENA increased investment (1 Bn€/year) does not mean short term increase in share price

Banc Sabadell | According to the press, Maurici Lucena (President of AENA) has commented that during the period of the next Airport Regulatory Document (DORA, 2022-26) the company will invest 1 billion euros per year (5 billion euros in the entire period).