Iberdrola, Acciona Energía, amongst favourites to play European energies theme

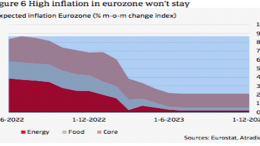

Morgan Stanley | Despite Gazprom cutting the gas supply via Nord Stream 1, Martijn Rats (our Commodities strategist) believes that rationing will not be necessary this winter. However he warns that Europe could enter winter 2022-24 with inventory levels which are too low. In response to this, the European Union has suggested introducing different measures: Limit the price of electricity for the “fixed cost” energy generators, 2. Limit the price…