Euro area: A chartbook of key economic indicators

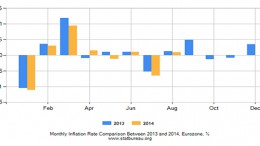

LONDON | The Corner | According to experts at Barclays, the significant depreciation of EUR/USD (Fig 1) has been a key data event in the past few months. However, the sharp fall in oil prices has partially offset this positive effect on inflation, which has remained at 0.4% y/y in August. The inflation data remain crucial for the ECB, which has repeatedly emphasised that there is unanimous commitment to use all available tools to prevent a period of prolonged low inflation. We now expect QE on sovereign bonds, most likely by Q1 15.