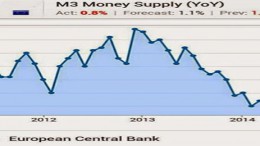

Draghi will have to do more than lowering interest rates

MADRID | By The Corner | Head of economic analysis at Link Securities Juan José F. Figares explains that if the ECB only reduces interest rates (i.e. intervention and deposit rates), stock markets will plummet since investors’ expectations will not be fulfilled. Should the central bank activate a new conditioned LTRO and open the door to a new asset purchase program, he adds that markets will react neutrally first and then, they will become positive. Note that the Eurozone’s GPD grew only by 0.2% in the 1Q14, according to the Eurostat.