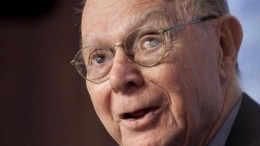

Alan Meltzer has a solution for the euro

WASHINGTON | “Capitalism without failure is like religion without sin, it does not work,” had already said Allan Meltzer in 1969. Pittsburgh's Carnegie-Mellon University teacher and author of the monumental History of the Federal Reserve is the same conservative who advised John F. Kennedy and Ronald Reagan. Under Clinton's presidency he was in charge of a U.S. Congress committee that essentially claimed the end of the World Bank on the basis…