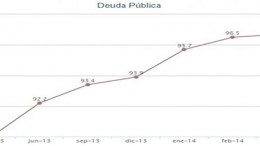

Spain’s public debt nears €Tr record- but still attracts investors

MADRID | By Francisco López | In the midst of the euro crisis, Spanish political leaders and some economists showed off about good figures of Spain’s public debt compared to Italy’s. Then, this indicator was a good example that reflected the strengh of national public finances. Now it has turned into a constraint, although fortunately investors do not doubt on the country’s ability to pay back.