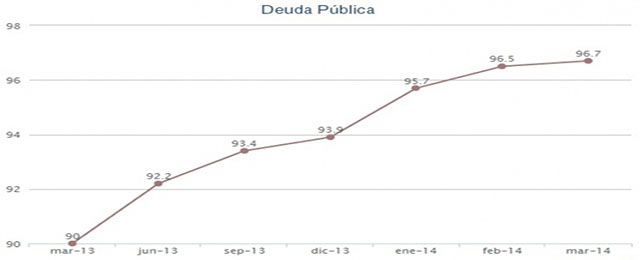

The benchmark of one billion euros is approaching, according to Bank of Spain. The whole of Spanish administration’ liabilities increased by €2.5 bn in March, beating for the first time €990 bn. Regarding GDP, this new upturn augmented debt by three percentage points to 96.8%, thus growing just in one quarter by 2.7%.

The Spanish government calculates to close current year at 99.5% of GDP, but if it continues expanding at present pace -of €10 bn monthly- public debt could reach the yearly goal before expected.

As optimism rules in the recently started European election campaign, the Ministry of Economy rushed to explain that this public debt rebound is “coherent” to their forecasts. They have linked the strong growth even to the Ministry of Finances’ putting their hands in their pockets to meet the providers payment plan, and also to the Treasury’s issues’ yearly average going ahead.

The government also trusts that economic growth for current year, which they expect to reach 1.2% of GDP, stops the liabilities increase because of an increase of the ratio’s denominator. However, owing money is never a good deal for one simple reason: sooner or later one must repay. Now nobody doubts that Spain is able to repay its debt, but this did not happen a couple of years ago.

The state’s public debt increased by €8.3 bn in March against regions’ growing by €3,7 bn and municipalities’ by €107 millions- these last were the out performers-.

In year 2007, public debt represented only 36.3% of GDP. Currently, it is at 96.8% due to the public deficit boom and to the financing needs of financial sector. Most of experts agree that the debt ratio regarding the GDP will continue to increase in next years, but at a more moderate rate than last times. Estimates point to a maximum benchmark of 105% of GDP by year 2017.

Be the first to comment on "Spain’s public debt nears €Tr record- but still attracts investors"