The ECB came to the fore, the European Union must now follow

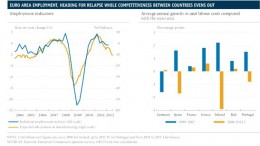

The ECB reduced official interest rates by 0.25%, but the interest rate spread for loans to firms and households has widened. Credit conditions vary from one country to another in the euro area. The European governments have to fulfil their duties if the euro is to stabilise.