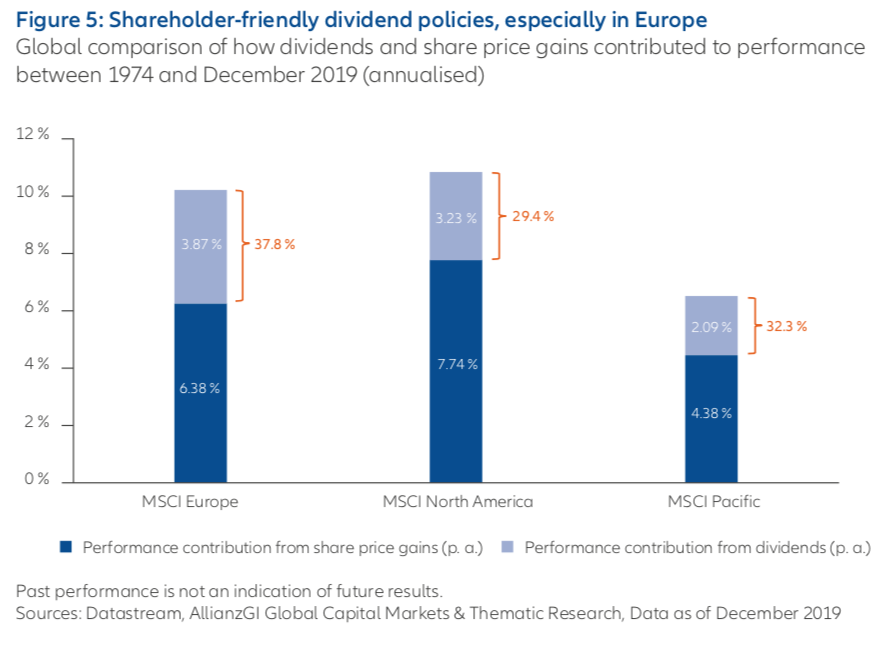

CdM | Allianz Global Investors expects dividend payments of approximately 359 billion euros from European companies in 2020. This sum exceeds the 2019 record by 3.6% (12 bn euros). Dividends have contributed an average of 38% to the performance of European equities since 1974.

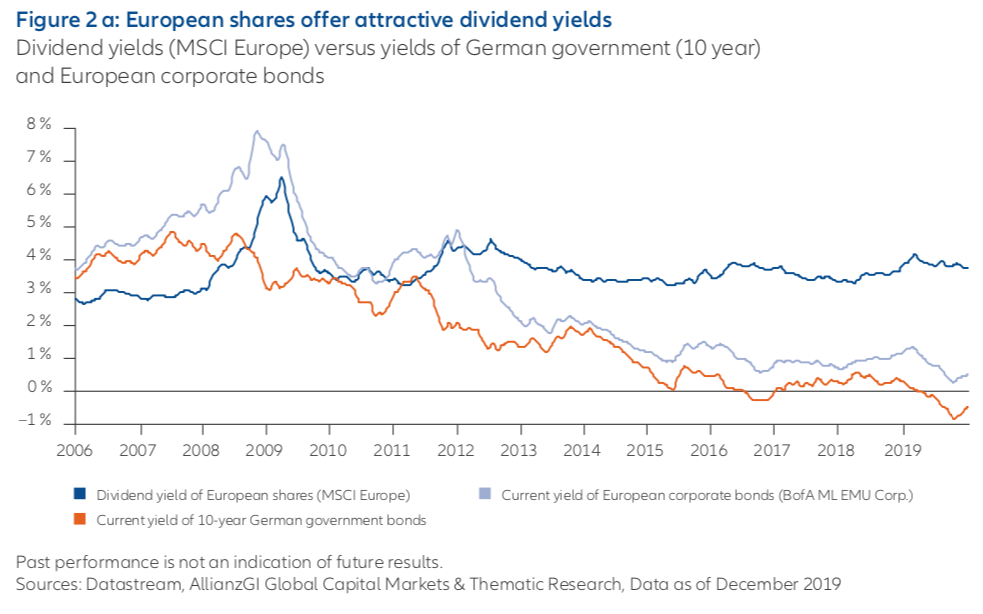

According to Allianz’s latest study, “Generating Capital Income with Dividends,” European companies have repeatedly proven to be particularly favorable to dividends in a comparison with the rest of the international companies. Its dividend yield was around 3.7% on average throughout the market. On the contrary, 60% of government bonds in the euro zone have a negative nominal return.

Jörg de Vries-Hippen, Director of European Equities Investments commented:

“Despite the risks related to protectionism, global economic growth has been able to continue (although moderate) thanks to central banks’ expansive monetary policy. The question of how stable the road is will persist in the new decade, just as the certainty of a surge in interest rates remains unrealistic. ”

For him, being active and having a vision for the future in a stable dividend environment remains, therefore, the maximum for next year:

“The sum of the expected disbursement of 359 billion euros exceeds the German federal budget last year. This is a strong signal for a solid economic base in Europe. ”

Market volatility cannot be ruled out in 2020. However, regarding the opportunities and risks for investors, Hans-Jörg Naumer, Global Director of Capital and Thematic Market Analysis and author of the Allianz Global Investors study, says :

- “As an alternative to the lack of interest rates, dividends can stabilize an investor’s portfolio in three ways: as a regular source of income, as an indicator of a robust business model and for portfolio diversification.”