Renta 4 | After solid results in 2025 and the achievement of its main objectives, attention now turns to the upcoming Investor Day in London on 25 February, where the bank will present its new 2026-28 Strategic Plan.

We believe that the new Strategic Plan will be continuous with the previous one, focusing on improving profitability as announced in the results presentation, with a post-AT1 RoTE target for 2028 >20% (vs 17.1% pre-AT1 and 16.3% post – AT1 in 2025), and above all, a clear focus on demonstrating how its transformation will translate into profitable and sustainable growth, supported once again by the implementation of its ‘One Transformation’ strategy and the promotion of its ‘Gravity’ platform, two key elements that should translate into cost optimisation.

We maintain our view that an improvement in shareholder remuneration from 2027 onwards, with a higher proportion of cash payments vs. share buyback programmes, would act as a catalyst for value, once the improvement for 2026 has been ruled out, as this will be a year of transition for the bank, with the deconsolidation of Santander Polska, and the inclusion of TSB in the United Kingdom and Webster Bank in the United States in the scope of consolidation.

The bank’s task is to convince the market that its business model and the changes to come will result in a stronger and more profitable entity, capable of maintaining high double-digit RoTEs above the cost of capital in the long term, as well as demonstrating and ensuring sustainable value creation for its shareholders.

Recommendation and P.O. Under review.

Update of financial targets.

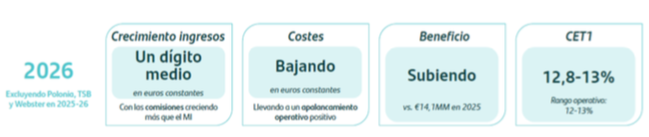

We expect greater detail in the update of the financial targets for the three-year period 2026-28 by main divisions and some more colour by country. The bank has announced that, excluding Poland, TSB and Webster in 2025-26, and assuming stable risk costs, they expect for 2026 revenue growth (constant euros) with net fees growing at a faster rate than net interest income, a decline in operating costs (constant euros), net profit higher than in 2025 and a CET 1 capital ratio at the high end of the target range:

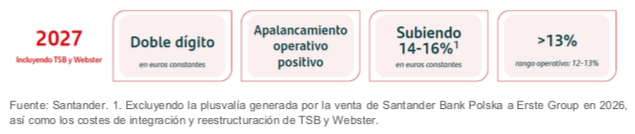

And for 2027, including TSB and Webster, the targets to be achieved are:

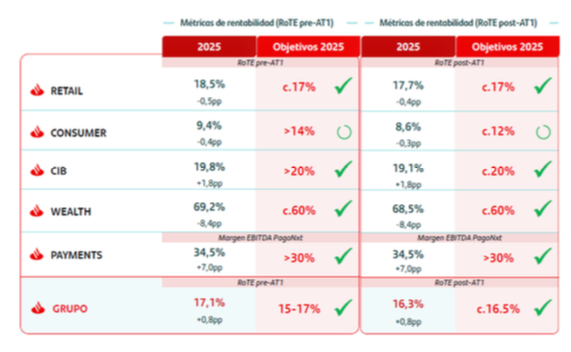

Strategy execution. It will continue to pursue the main objective of improving profitability after meeting the targets in 2025 and setting a RoTE target for 2028e >20% (post-AT1):

A strategy that should continue to rely on the implementation of ‘One Transformation’ and promote its ‘Gravity’ platform in all its markets as a fundamental component. ‘Gravity’ is software and a digital platform developed internally by the bank to migrate its core banking to the cloud. The implementation of ‘Gravity’ allows Santander to:

- Greater agility: reducing the launch time for new features from weeks to hours.

- Efficiency: by improving operational performance and reducing service costs.

- Customer experience: offering faster access to data and a more agile and secure experience.

- Innovation: competing with digitally native companies by operating 100% in the cloud.

Dividend policy. The market’s expectation ahead of Investor Day was an improvement in shareholder remuneration from 2026 onwards. However, the announcement of the Webster purchase led the bank to confirm its commitment to remunerate shareholders with an ordinary payout of 50% (25% in cash and 25% in share buybacks), with a target of at least €10 billion in share buybacks charged to the 2025-2026 results (against €6.7 billion executed+announced) and the expected capital surplus.

We believe that an improvement in shareholder remuneration with a higher cash component, bringing it closer to the average for listed banks of around 50% (compared to 25% for Santander), would be well received by the market. Alternatively, an increase in the payout would also be welcome, although we consider this option less likely.