In the first half of 2015, Santander posted substantial growth in business and revenues, which also benefited from exchange rates, particularly the euro-dollar and euro-pound depreciation. Business and revenues grew over 12%, 7% without the exchange rate effect. This factor, combined with a 5% drop in loan loss provisions (9% without the exchange rate effect), fuelled a 24% rise in net attributable profit in the January-June period. Without the exchange rate effect, the increase would have been 16%.

Banco Santander’s results were achieved in the context of an uneven economic performance across the different countries where it operates. Countries like Spain, the U.S. and Poland are expected to grow more than 3% this year; the U.K., Mexico and Chile, more than 2.5%,and Germany and Portugal, over 1.5%. Meanwhile, Brazil and Argentina will register a decline in economic activity. Official interest rates in euros, dollars and pounds continue to beat historic lows.

The improvement in first half profits is a result of a 12% rise in revenues, compared with an 11% increase in costs. This allowed for a continued improvement in the bank’s efficiency ratio to 46.9%, which makes Banco Santander one of the most efficient financial institutions in the world.

Net operating income, the difference between income and costs, grew 13% to EUR 12.256 billion. This increase, together with the 5% decline in loan loss provisions, means that net attributable profit rose 24% to EUR 3.426 billion. That figure does not include the EUR 835 million from the reversal of tax liabilities in Brazil, which allowed the bank to strengthen its capital ratios.

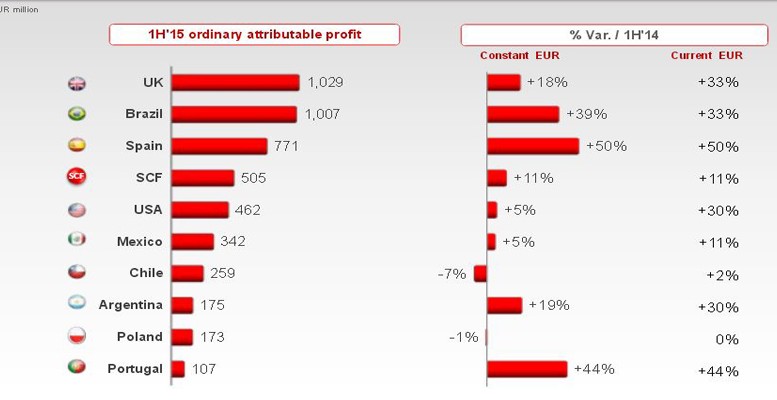

Emerging economies (Latin America and Poland) accounted for 41% of profit and mature markets contributed 59%. By country, the largest contribution was from the U.K. (21%), followed by Brazil (20%), Spain (16%), U.S. (9%), Mexico (7%), Chile (5%), Poland and Argentina (4% each) and Portugal (2%). Santander Consumer Finance contributed 10% to total group profit.