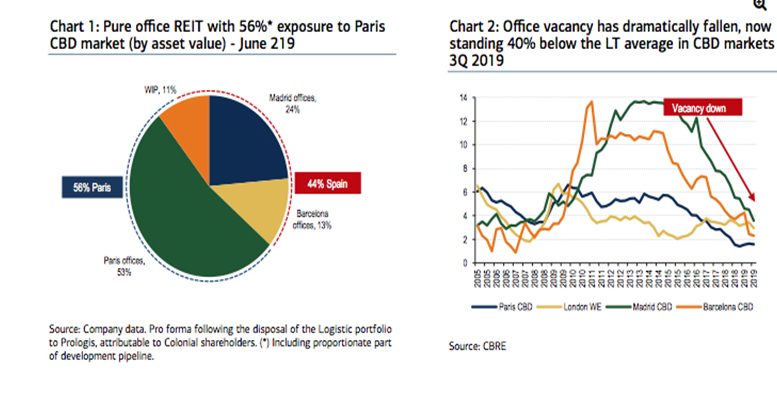

BofA | Prime offices in Paris, Madrid and Barcelona are enjoying a resurgence on 1) rising property prices as prosperity and hence urbanisation increase in cities, 2) 2.6x faster growth in office-related jobs vs total employment, and 3) office vacancies in the central business district (CBD) sitting 40% below the long-term average, fuelling rental growth. We reinstate coverage on Colonial, the largest pure prime office REIT in Europe, with a Buy rating and €12.9 (17% TSR) as we expect the company to deliver among the highest total property return, at 14% pa over 3Y, owing to a strong rental and capital value growth and its accretive development pipeline. The stock trades at a 14% discount to next year-end NAV, compared with a 6% discount for London office REITs with a 6% return, on our estimates.

Spain brings upside, Paris resilience

Almost half of assets are located in Madrid and Barcelona; both cities should see office employment growth of 2% pa into

2023. This should keep office absorption above new supply, pushing up rents as vacancy declines. Rental and capital value growth should thus exceed 4% and 7% pa for Colonial’s assets in Spain. Growth in Paris

should be subdued, but we believe this exposure brings resilience as the first tenant exit is due later than in Spain, rent volatility is lower (Paris peak to trough stands at -15% vs -38% in Spain), and the Paris pipeline should unleash at least 5% of NAV.

More growth to come – Buy 2020E NAV (€12.9 PO)

Despite the rally year-to-date, we still expect the shares to benefit from strong growth. Colonial trades at a 14% discount to next year-end NAV vs. a 22% average discount over the last 3y. We do not see this discount mean-reverting, as investor appetite for offices remains high, we expect strong growth in rents and capital, and management has a proven record of bold accretive acquisitions.