Barcelona-headquartered bank “la Caixa” is targeting an increase of 20 percent in private banking managed funds, and a 15 percent market share in Spanish private banking by 2015. The entity will need to be re-capitalised by June 2013, according to the current timetable the government has given to those financial institutions that have not received public cash injections.

“la Caixa unveiled its strategy to drive growth in private banking with the introduction of a new model of interacting with customers. The entity said it will use the web 2.0 tools to provide tailored services to high value clients.

The new services will be directed at “la Caixa”‘s over 38,000 private banking customers and more than 615,000 personal banking customers. “la Caixa” manages a total of €67 billion funds in personal banking and €39 billion in private banking.

“la Caixa” will use new technologies to provide customised private banking and personal banking services, based on a multi-channel format that includes groundbreaking services in the industry,” the bank explained in a press release, “such as the bank’s own social networks, video-calling, full remote product and service contracting, online MifID suitability tests and consultancy contracts.”

The new interaction model for managers would allow “la Caixa” to provide new means of communicating with asset managers and access to investment and monitoring reports among others. The institution indicated that it will include financial training modules and self-planning tools.

The services will be available at their branch, or on mobile devices like computers, tablets or smartphones.

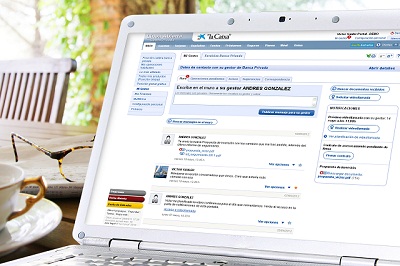

“la Caixa”‘s most striking new feature is called “Wall”, an online space designed for private and personal banking customers based on the social network concept. Conversations can be held with asset managers (via written messages or videocalls) and customers can be provided with investment suggestions and customised portfolio tracking reports.

“la Caixa” has been named the world’s most innovative bank at the Global Banking Innovation Awards, beating 200 banks in 40 countries to the award.

In Spanish banking for individuals “la Caixa” serves the largest number of users of internet banking (more than 7.3 million Línea Abierta customers), mobile banking (more than 2.6 million users, of which one million actively use mobile phone banking services), e-banking (12.5 million cards issued) and electronic multiservice terminals, with the largest ATM network in Spain and one of the most extensive in all of Europe (more than 10,000 ATMs).

Be the first to comment on "‘la Caixa’ turns into Facebook-like service for €8 billion growth in private bank funds"