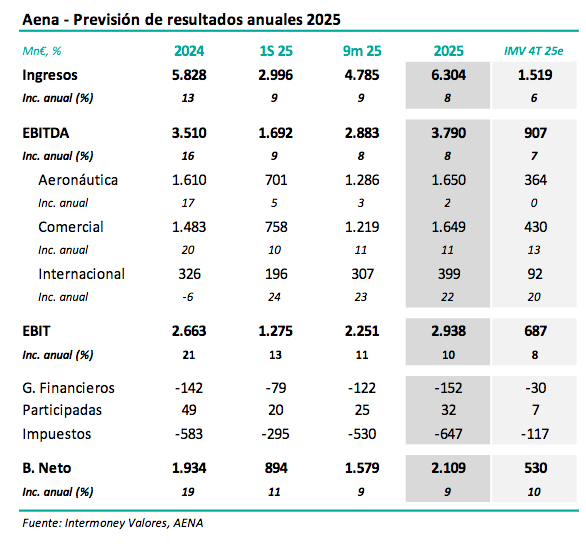

Intermoney | The company will present its 2025 annual results on Wednesday, 25 February, before the market opens, and is expected to hold a conference call on the same day at 1:00 pm. Following the traffic data in Spain for December (up 4%), continuing the expected moderation, we believe that the P&L figures should reflect this, something already evident at 9m. We therefore estimate EBITDA growth of 8% to €3.79 billion, as shown in the table below, significantly higher in Commercial (11%) than in Aeronautics (2%). We estimate net profit at €2.109 billion, implying 9% annual growth. Following the September figures and the annual traffic data, we have very slightly reduced (down 1%) our EBITDA forecasts for 25-27. We have not yet taken into account the operator’s announcements of long-term investment in Spain.

We confirm our Hold recommendation, which we downgraded from Buy in June, despite raising our target price at that time from €21.5 to €24. Overall, we believe that the greater stability in Aena’s operations is already adequately valued by the market. We then raised our EBITDA forecasts by an average of 3% in 25-27, placing us 3% above the consensus, which led to the aforementioned increase in the target price. We continue to value Aeronautics and other activities separately by DFC with WACC of 8.0% and 8.75%, respectively, as of December 26. Our downgrade was therefore based solely on valuation; after a good start to the year, the stock now shows slight downside potential. We believe that a sharp increase in long-term capex (not yet included in our forecasts) would represent a potential risk to maintaining the current 80% payout.