Intermoney | The company will present its 9M25 results on 7 November before the market opens, holding a conference call on the same day at 1 p.m. The figures should confirm the slowdown in growth compared to 2024, driven by the mediocre performance in the US and the Middle East, as well as the relative depreciation of the dollar, meaning that both revenue and EBITDA should grow by around 6%, compared to double digits last year. The specific figures for our forecasts are shown in the attached table. We estimate a net profit of €1.075 billion (up 8%). We confirm our forecasts that EBITDA will fall by 3% in June for the 25-27 period due to the US and FX, implying a CAGR of 9% 24-27. At 25 estimate (up 9%), we are in the middle of the company’s guidance range, which was revised after Q1 and confirmed by Amadeus in July.

We confirm our Hold rating due to low potential and geopolitical uncertainties.

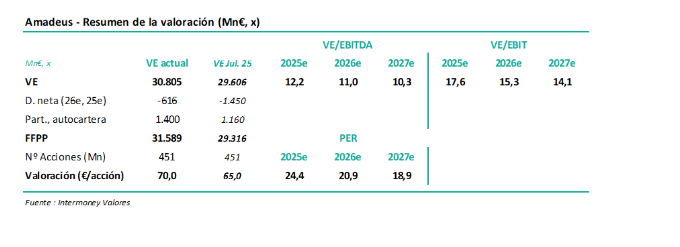

We confirm our Hold recommendation on Amadeus, although we raise our target price to €70 from €65, due to the discount date being moved to December 2026 from December 2025 previously. The stock does not offer great potential at current levels. However, we believe that the quality of the stock, given its position as the GDS market leader, should provide support, and we are therefore comfortable with our Hold recommendation. Recent tariff developments in the US with regard to the rest of the world pose a downside risk to our forecasts, which is another compelling reason to remain cautious on the stock.