The Cypriot Parliament was to decide over the issue of the deposit levy, but sources stated that they postponed the issue until today [further delays rumoured]. I am not a Member of the Parliament (not a very pleasant occupation these days) yet if I were, I would be worried about several complications the 6.75-9.9% tax would cause.

1. What happens to the money? If the haircut goes through, then the two big banks (Cyprus Popular and Bank of Cyprus) will have an additional €5.8 billion in cash. From what I can assume, approximately €4-4.8 billion will be put to the former bank and €1.8-1 billion to the latter bank in order to raise their capital adequacy ratios (namely Core Tier 1 and Tier 1). Then, as shareholder equity will be increased to account for the increase in share number, cash amount will also be increased by those amounts. What will the banks do with that money? If we assume that assets are down (due to the levy), adequacy ratio will not be so hard to reach and even exceed. Thus, the banks remain with three options: use it to infuse liquidity in the market by way of lending, keep it as reserves or fund government debt.

Option 1 would be the best for the overall economy, since it will boost businesses and assist in both consumption and investment. The only drawback is that the Cypriot people may just be too scared to invest or consume now. Option 2 will do nothing more than safeguard the banks in the case of the economic environment worsening (which it will if Option 1 is not used). Option 3 will be very good for the state, yet the economy will not be able to enjoy this as the state cannot boost activity through payments or investment (given the austerity measures and its agreement to abide by it and reduce its budget deficit).

Ideally, a combination of all three would be the best choice. Keep some money as reserves, boost the economy by providing liquidity in the form of loans and fund some government debt in order for the state to continue functioning smoothly.

2. Why does Cyprus need so much money (about €10 billion) to sustain its government debt if its deficit will be less than 3% in 2013 and Russia will roll-over the €2.5 billion loan?

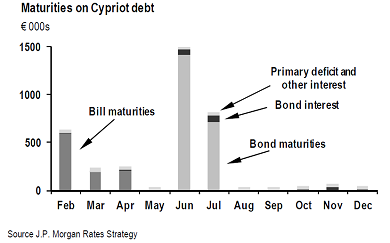

The question is pretty obvious: if the 2013 deficit is expected to be approximately 3%, which is considered a yardstick for debt stability, why does the island need €10 billion? In 2013 the debt maturities are:

Be the first to comment on "After the Cypriot bank deposit one-off tax"