MADRID | According to Alberto Vigil, analyst at Barclays in Madrid, the peripheral euro risk and particularly Spain’s has been exaggerated by the markets, which would be discounting an economic situation perceived as poor and with a very limited range of choices.

Yet, Vigil maintained an optimistic opinion and said investors will reconsider their position when reviewing the strengths of the country.

“Spain could have done its reforms much better, but the fact remains that it has introduced major and urgent changes. The labour reform should increase the potential growth of Spain. The banking reform should calm the markets in terms of its exposure to the construction sector, I mean, if you have repaid 80% of your exposure …there is not much more to worry about, right?

Vigil believes markets would welcome a tougher stance from the central government in its dealings with the regions.

“The fiscal reform should assure investors that the government is set to curb the regions’ excesses, although it is true that we would love to see that the government is able to intervene some of the autonomous regions that have been the worst offenders.

There is no doubt that the Spanish government could have worked out better its image abroad and, why not to say it should have avoided some blunt mistakes, but it certainly has done positive things. The announcement to cut spending in health and education, which the regions control nowadays, will sooner or later be appreciated by the markets as a good step.”

The expert explained that the Spanish government has collected almost half of its funding needs and,

“if it can demonstrate that it is doing its duty, if it reigns in the rebel regions, I have no doubt that Spanish banks, and ultimately the Spanish families will gladly buy national debt. It makes no sense to miss on returns of 5% or higher and pile instead one’s savings in a current account at 2%, above all if we consider that banks will go bankrupt if the Spanish Treasury fails, so better to make a bigger profit bearing the same risk.”

He thinks the widening of Spanish spreads over German bunds is a temporary effect that will be reversed. Italy, though, offers a worse forecast.

Now, the question: how much more can the markets because of the peripheral market risk?

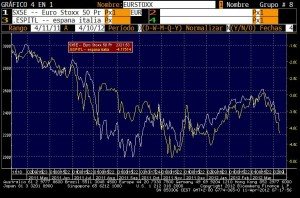

“If we rely on historical relations between the peripheral spread (mean Spain/Italy) and Eurostx 50, we get that the current differential spread would be consistent with a Eurostxx 50 at 2200. That is, it still has a fall of 5% ahead. In any case, I expect to see a narrowing of the spreads to start neutralising the short positions.

“The market has been quick to discount the difficult situation in which Spain finds itself. But sooner or later the go-long-Germany/US, go-short-Spain will make a U-turn.”

Be the first to comment on "Barclays’ Alberto Vigil: “markets will pressure Germany and trust more Spain”"