LONDON | Investment professionals in the UK favour a more pleasant global economic outlook than in previous quarters, although the sector still remains cautious. The results from the latest Barings Investment Barometer showed Monday an increase in optimism, with concerns over the risk of a double dip recession reduced by almost two-thirds and number of advisers citing it as a major global macroeconomic challenge at just 10%, down from 28% in Q4 20112.

LONDON | Investment professionals in the UK favour a more pleasant global economic outlook than in previous quarters, although the sector still remains cautious. The results from the latest Barings Investment Barometer showed Monday an increase in optimism, with concerns over the risk of a double dip recession reduced by almost two-thirds and number of advisers citing it as a major global macroeconomic challenge at just 10%, down from 28% in Q4 20112.

The quarterly survey, which explores intermediaries’ attitudes towards the current economic environment and their views on major asset classes, revealed that worries about a second banking crisis was also down, with just one in four (28%) of investment professionals worried about this, down from 61% in the last survey.

Nevertheless, the overwhelming majority (84%) of respondents remain concerned about the euro zone debt crisis. Only 43% feel neutral or favour European equities. Similarly, investment professionals remain concerned about the ability for over-leveraged economies to reduce their debt, with 68% of respondents citing this as a one of the major impediments to investment growth.

Rod Aldridge, Head of UK Retail Distribution at Barings, commented that the Greek bond haircut agreement had been partially successful.

“In light of the Greek bailout agreement, it is clear that sentiment towards the economic outlook is becoming more positive,” Aldridge said, “however, investment professionals continue to look to the diversification of assets as an increasingly popular strategy in order to de-risk clients’ portfolios.”

“Emerging markets, many of which have escaped the effects of the on-going credit crisis, appear relatively unscathed and continue to show strong potential for growth.”

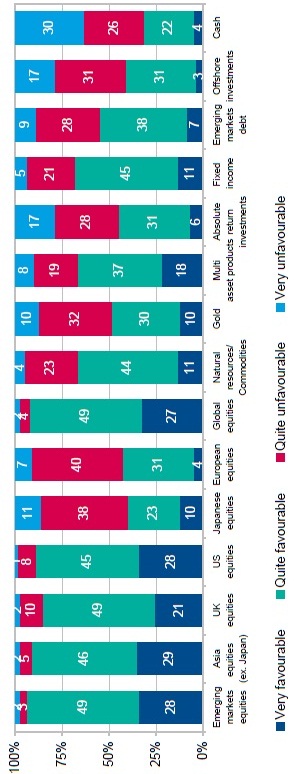

A massive 94% of advisers were favourable towards emerging markets, the highest of all asset classes and sectors, closely followed by Global equities (93%) and Asian equities (ex Japan) (91%). 89% of respondents were favourable towards US equities and 85% towards UK equities.

Furthermore, 56% of all investment professionals are advising their clients to increase exposure to emerging market equities, and 42% to Asia (ex-Japan) equities. Respondents remain cautious of Japanese equities with three in five (60%) not favouring.

Be the first to comment on "Baring Barometer: only 10% of investment professionals fear a double dip recession"