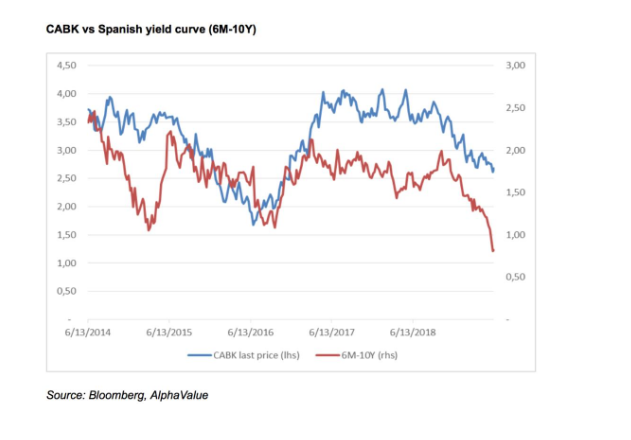

Alphavalue | The ECB´s reflationary strategy has caused doubts among investors about the business plans of Spanish banks, in particular Caixabank, articulated in terms of the improvement in the net interest margin over the expected future rise in interest rates (which, incidentally, we do not expect any time soon).

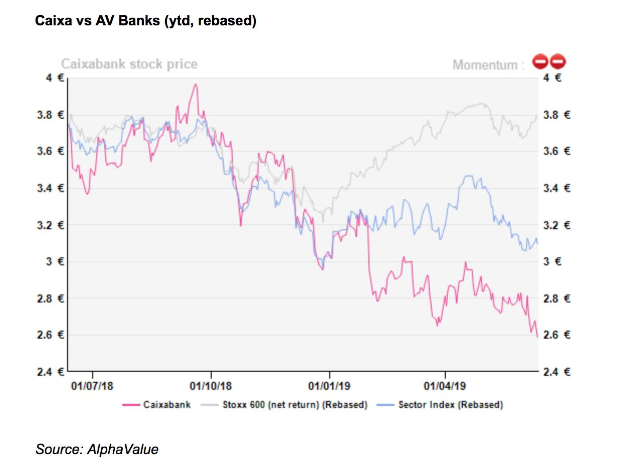

The consensus expectations are now to a large extent in line with our projections, which only take into account the improvement in the margin. In our opinion, there is limited additional risk of a cut, which perhaps makes the discount over the valuation of the NAV excessive. Since the beginning of the year, Caixabank has competed with Deutsche Bank and Société Générale to be the second worse performer in the banking sector after Danske. With a correction of -12%, the share is underperforming compared to the sector by -18% YTD and -27% compared to the AlphaValue universal.

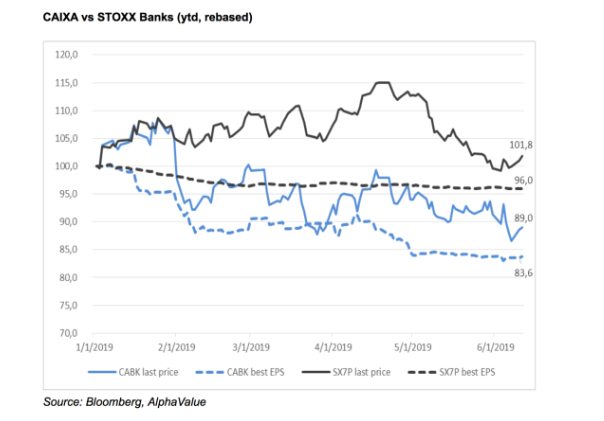

The picture is the same when compared to the Stoxx Banks index (SX7P). As shown in the diagram below, the underperformance is in large part attributable to the negative momentum of the profits outlook one or two years ahead.

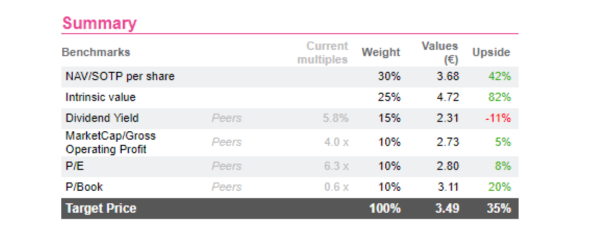

At the beginning of 2018, we warned that the gamble on relation which had been developed would probably be lost. Our recommendation for Caixabank became positive again only at the beginning of March this year. As happened before, the adjusted PER for 2019, because of the greater indebtedness of the group (and the costs of restructuring) is 8X, which points to a minimum upside potential of +25%. Our objective price, which corresponds to the weighted average of six different foci of valuation, suggests a slightly greater potential (+35.1%). Thus we have to be alert to the improvement in momentum, without which we cannot make a totally positive recommendation.