So we have the Troika’s Debt Sustainability report and the related financing document (kudos to the FT: others had it, only they posted it publicly. Worth reading Peter Spiegel’s post too) and what a shabby, despicable little document it is. The Cyprus negotiations started with a high-risk gamble – that depositors would bear part of the pain of restructuring; unfortunately, the Cypriot parliament then tried to bluff the Troika whilst declaring loudly that they didn’t have any cards at all, and a catastrophe was duly created.

Two-part post: greatest hits from the DSA/EFN; and a quick run-through the “Template” aspects of the solution.

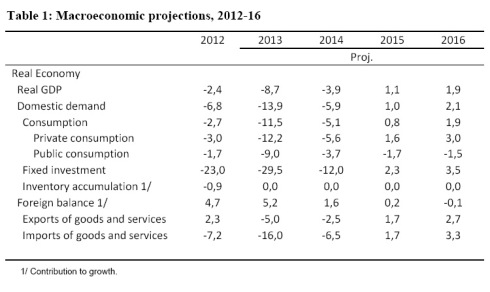

1. The economic forecasts are worse than literally laughable (table). The drops in consumption and investment look dementedly optimistic given the events of the past month. Exports to drop a mere 5% with the destruction of the banking industry and the introduction of capital controls. The wealth effect wiping deposit worth 60% of GDP will apparently barely register on consumption – the Troika must think the deposits are all Russian. Compare with Iceland (50% drop in investment) or Latvia (40%), the former boosted by devaluation the latter by an intact financial system. Public consumption drops 9% – Iceland held the line here, and we have bitter experience from Greece on how big fiscal multipliers are. These projections cross the line from wild optimism into contemptuously half-hearted fable. This table is a bare-faced lie.

2. The attempts to haircut depositors have turned into a fullscale scalping. Aided and abetted by the Cypriot parliament, the bailout cost is EUR5bn higher than the original March 23rd plan envisaged – the pricetag for a mere 5 days. All of this falls on the depositors in the 2 big banks. As the FT notes, that’s 30% of GDP. Great job, Jeroen!

3. The fiscal projections suffer from the persistent Greek problem: undershoot fiscal targets – slaughter economy with new measures to get back to targets – undershoot revised targets. “Insanity is repeating the same mistakes and expecting different results” (Narcotics Anonymous Basic Text, not Einstein, apparently).

4. “Sale of Excess Gold Reserves” for EUR400m. My instant reaction to this is “WTF?”. May have an aim other than being a nifty piece of political humiliation, but buggered if I can see what it is.

It is envisaged to use the allocation of future central bank profits of approximately [EUR 0.4bn], subject to the principle of central bank independence (double WTF?)

5. The banking sector shrinks. The domestic banking industry shrinks at a stroke from 550% of GDP to 350% by a deft combination of taking people’s money and stripping the Greek operations (120% of Cypriot GDP) out and selling them to Pireaus. Given that the Greek operations were to a significant degree responsible for the disastrous GGB trades that wiped out the banks, and given that Pireaus stock rallied sharply afterwards, the Cypriots find themselves in the position of the Blackadder character who not only had a relative murdered, but had to pay to have the blood washed out of the murderer’s shirt. (excellent stuff here on how the Cypriot banks blew up, based on leaked documents).

6. A number of other policy steps will alleviate financing needs over the programme period, but with limited or no impact on the public debt trajectory: i) the Cypriot authorities will endeavour the roll-over of up to EUR [1.0] bn domestic law long-term debt maturing during the programme period. In order to implement this, the Cypriot authorities intend to undertake a voluntary sovereign bond exchange covering bonds maturing in 2013-15.

Tipping their hand a bit there with that “domestic law” stuff. Clearly they don’t see much hope in getting rollovers from foreign investors protected by foreign courts. “Voluntary” is as ever a term the EU seems to struggle with, confusing it with “doing what we want”. At best, moral suasion on banks and local institutions, at worst more Greek-style ex-post re-writing of bond covenants.

This brings us to the question of why the programme looks like this. The (admittedly laughable) debt estimates in the DSA top out at around 65% of peak Greek debt:GDP and below where non-programme Italy is this year. Note that carefully: the Troika felt a path that took Debt:GDP above Italian levels was so dramatic that it required scalping bank depositors. “Sustainability” is a flexible thing. The priorities of the EU have shifted over the years.

The EU is recognising moving towards a new regime of bailing in banks – reducing the size of and protecting core contributions to ESM et al has become a major priority. While what happens will not be identical to Cyprus because Cyprus banking system was unusual in size and structure. For a non-Template, the Cyprus solution drops some cracking clues as to EU priorities. At present, the capital structure is equity, subordinated debt, then senior debt and depositors together. The new hierarchy will be: equity, sub debt, senior debt, uninsured depositors, and then at the top of the mountain as the floodwaters rise, voters insured depositors (remember that while a very big chunk of deposits are uninsured, almost all depositors are) the ECB and the Eurosystem (the Central Bank of Cyprus remains part of the Eurosystem family, albeit a red-haired stepchild). The ex-Bank Laiki had around EUR9bn of ELA claims at the ECB – enough to severely dilute the depositor haircuts had it been bailed in as per its legal status. In its anxiety to prove Professor Sinn wrong and that ECB claims are not a problem for Germany, the Troika has made it clear that they are a problem for the periphery.

Furthermore, after the Greek PSI, sovereign debt is out of the firing line. Cypriot banks were “different” in having a very small layer of non-depositor debt. But the EU is already divvying up various special classes of “bailinable” and “non-bailinable” depositor. This includes apparently putting interbank deposits on the firing line, presumably because they feel that Mr Draghi is a little comfortable post-OMT and would like the challenge of defrosting a frozen interbank money market.

Citi were out this week with a handy spotters’ guide (thanks Simon Hinrichsen for link) to figuring out which depositors should worry.

For depositors to be at risk, three conditions have to be satisfied. First, there have to be systemically important banks, that is banks whose insolvency would cause economic and financial damage significantly larger than the losses of the directly involved bank creditors. This likely requires a large banking sector (..). Second, depositors have to be a large share of total bank funding,… Third, the banks have very poor asset quality and are insolvent, with the insolvency gap exceeding the value of the banks’ unsecured liabilities other than depositors.

So this comes down to an issue of asset quality. If the assets are good, then this will probably blow over. If they’re not, and uninsured depositors start to worry, this could get very messy very fast. Good job that we’re endlessly reassured that European banks are in fabulous shape.

*Read the original post here.

Be the first to comment on "Cyprus: Of course it’s a template!"