The European Stability Mechanism (ESM), the European rescue fund, will have a lending capacity of up to 500 billion euros. Creating this permanent fund is a key element in constructing a more integrated economic union capable of withstanding shocks. However, its start-up has led to some discrepancies within the euro area. In particular, a joint memo from the Finance Ministers of Germany, the Netherlands and Finland expressed their opposition to the ESM being in charge of directly recapitalizing banks whose problems had arisen prior to the start-up of the common bank supervisory mechanism. They believe that these «legacy assets» should be the responsibility of the member states in question, a situation applicable to Spain.

For its part, the Spanish government is continuing to fulfil the commitments acquired through the Memorandum of Understanding to restructure Spain’s banking sector. Specifically, it has published for public debate a draft of the Royal Decree implementing the legal framework that will govern the Asset Management Company (AMC) or «bad bank», legislation that will be passed on 16 November. The company will be called Sareb (Sociedad de Gestión de Activos Procedentes de la Reestructuración Bancaria) and will have a maximum asset volume of around 90 billion euros. Most of the assets transferred will come from the real estate sector, in the form of land or developer loans. One of the most relevant issues is also starting to be defined: the transfer value of these assets, which will be fixed by the Bank of Spain and will be equal to the economic value minus expected losses due to unfavourable price trends, less management and administration costs. However, the ultimate determination of the value and discounts has yet to be defined.

In spite of the progress being made in sorting out Spain’s banking sector and in building banking union at a European level, bank funding costs are still high and access to credit is still restricted. The latest information available for the month of August shows that the drop in official interest rates, such as the Euribor, is not being entirely reflected in financing costs borne by households and firms. This is the case because interest rate spreads have widened. For example, bank loans totalling less than one million euros to non-financial firms of up to one year had an average interest rate of 4.56% in August 2011. Given that the official interest rate of the European Central Bank was 1.50%, the average spread was around 3 percentage points. One year later, in August 2012, the average interest rate for these loans is 5.35% while the official ECB rate is 0.75%. This gives a spread of 4.60 percentage points, substantially higher than last year.

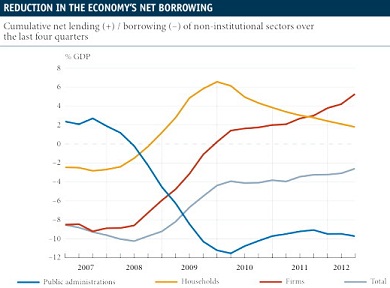

The NPL ratio stood at 10.5% in August, reaching a new record high. This rise is due both to an increase in doubtful loans and also the fall in outstanding loans on the balance sheets of financial institutions. In fact, private sector financing has continued to fall, down 3.6% year-on-year. Loans to non-financial firms shrank further, by 3.8%, than loans to households, by 3.2%. These figures confirm that private sector deleveraging is continuing. In fact, in aggregate terms these sectors are showing net lending. According to the quarterly accounts for non-institutional sectors, households reported net lending of 9.8 billion euros in the second quarter, equivalent to 3.6% of GDP quarter-on-quarter. For their part, non-financial firms recorded net lending of 7.5 billion euros in this period, representing 2.8% of GDP quarter-on-quarter, 0.8 percentage points higher than the figure recorded a year ago.

A very different view is provided by public administrations, which are continuing to significantly increase their debt. In August, the year-on-year growth in bank credit to the public sector was 13.7%. Figures from the quarterly accounts of non-institutional sectors show that, in the second quarter, public administrations had a net borrowing of 29.7 billion euros, 11.0% of GDP quarter-on-quarter. However, it should be noted that the economy as a whole has substantially reduced its net borrowing compared with the rest of the world. In the second quarter of 2012, this totalled just 855 million euros, 0.3% of GDP quarter-on-quarter. This is a positive figure that illustrates the correction of imbalances accumulated during the first decade after joining the euro.

In summary, to restore the flow of credit to the real economy, it’s crucial for the bank restructuring process to be successfully completed over the coming months. In this respect, the start-up of the new Sareb should help. At a European level, it’s important for construction to continue and to dispel doubts regarding whether European rescue funds should recapitalize banks with prior difficulties or not.

Be the first to comment on "Details published on the Spanish «bad bank» Sareb"