One of the measures that today trend the most to get the picture of market confidence–or lack of it–is the spread between the profitability investors ask for from Treasury bonds of any euro country against Germany’s. In Spain’s case, 10-year government bonds yield 5.35 percent while their German homologue paper yields 1.37 percent. The expectation over probabilities of a Spanish default is higher, and so it is the cost of credit for Madrid and the rest of agents of the Spanish economy.

For instance, in the fixed income market, Spanish corporations that have been graded at the same level that other European competitors must pay more to their bondholders. The situation is not better in the equity sector, so Ibex listed companies need to offer larger rewards than the German Dax-listed ones. Because investors feel risk averse, there is low demand and prices are dragged down as a consequence.

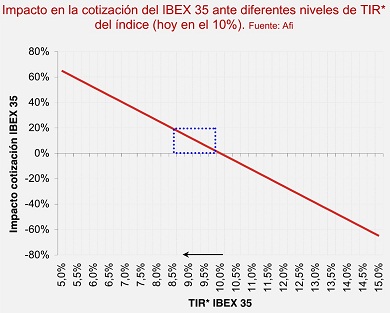

At Afi, analysts have looked into internal rate of return or IRR rates of Ibex 35 and Dax and have concluded that investors seek a 10 percent IRR from the Spanish stock market against a 6 percent from the German listing.

The spread is 480 basis points, and it is of 397 basis points between sovereign bonds. Afi believes there is a 60 percent correlation here, and a tightening of the difference would push stock prices. A sovereign spread lower than 300 basis points could have a positive impact of Ibex share prices going up by 12 percent to 15 percent.

In this optimistic scenario, investors would expect Spanish stocks to yield some 9 percentage points less and companies could access external credit more easily–to support expansion plans. Afi analysts note that there still are further downward movements to witness, though, before reaching this turning point.

Be the first to comment on "Ibex 35 prices could increase by 15pc if sovereign spreads falls under 300bp"