By Luis Arroyo, in Madrid | In case you needed tangible proof of the harmful role the ECB played in the crisis, in the FT, Martin Wolf writes an open letter to Trichet’s imminent successor to the presidency of the ECB, Mario Draghi. The letter is an excellent article that convincingly explains why the ECB should stabilize the debt markets of solvent countries such as Italy and Spain, which are the root of the problem.

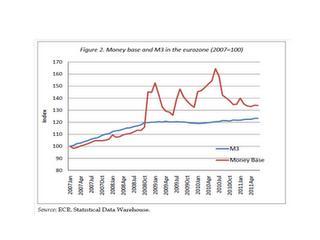

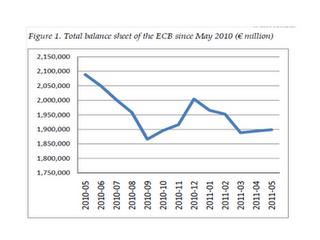

The article is based on a paper by Paul de Grauwe (click here), which analyzes what the ECB has done so far. Two graphs summarize the case: in the first, we can see that the ECB issued currency (monetary base) very sporadically, and we can also see that these changes have not affected the M3 base, that is, the broad measure of money in circulation. In the following chart, you can appreciate the ECB’s practical lack of willingness to act as a last resort lender, as has repeatedly been stated,

and how in reality it actually reduced, during the worst moment of the crisis, its asset levels. This explains the current crisis of falling government bonds and the decapitalization of banks.

and how in reality it actually reduced, during the worst moment of the crisis, its asset levels. This explains the current crisis of falling government bonds and the decapitalization of banks.

The justification for this attitude is that the ECB should not address solvency problems … But, who can distinguish between liquidity problems and solvency ones? As de Grauwe says, if it were easy, markets would and we would not have any problems.

But it is not easy: liquidity produces insolvency when prices fall, and insolvency causes illiquidity, because the bond loses value as collateral.

This answers the question: Why is it that the United Kingdom, which has far worse fiscal figures than Spain, enjoy the confidence of the markets? The answer is: it maintains a central bank of its own.

It is possible, and even probable, that some fool (there are actually plenty around) say: but that’s inflationary!

First, it need not be, as evidenced by the fact that the variations in the monetary base are not transmitted to the M3. Second, we wish we were now having to curb inflation because the economy was growing and the unemployment rate was at its natural level!

Luis Arroyo is a former Bank of Spain economist. He writes for www.consensodelmercado.com.

Be the first to comment on "ECB's nefarious attitude: Mr Wolf is right"