BofA Merrill Lynch | The virtuous cycle of credit-capex-growth needs a quantity and quality-driven credit recovery. The latter is lagging behind. The ECB has created the necessary conditions for credit revival. Stronger forward guidance would help to preserve them. UK: there are bright spots of course, but the balance of evidence leads us to cut our 2018 growth forecast to 1.0% from 1.2%.

Quantity vs. quality check of Euro area credit flow

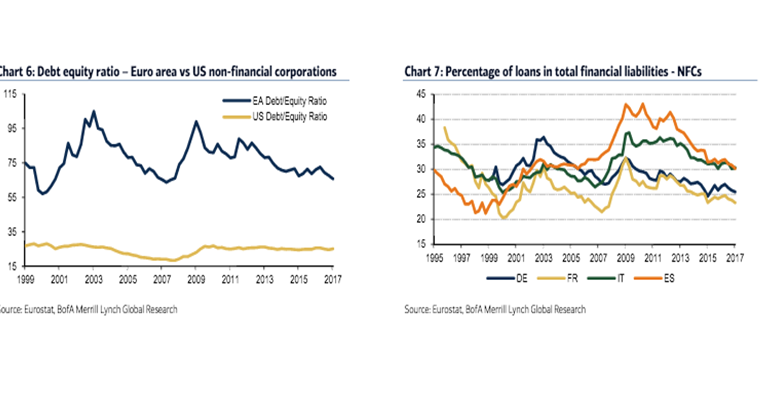

Some would argue that the slowing credit recovery is a sign of failing ECB stimulus. We disagree. In our main article this week, we have a close look at credit origination in the Euro area. True, our ‘credit impulse’ measure has gradually weakened since 2016H2, but quantity of credit still looks decent, in our view. Meanwhile, we noticed the emergence of a “two-speed” credit recovery, with better household but fragile non-financial corporate lending. This sub-optimal quality of credit has implications for the virtuous cycle of credit-and-investment-growth.

ECB: forward guidance to preserve lending conditions

The ECB is not to blame for this. Supply and demand surveys of bank lending agree that lower policy rates, QE and TLTROs have helped to revive credit origination in the Euro area. Necessary conditions for credit growth revival have been created. But the previous credit crunch episodes have left scars: we estimate that the sensitivity of non-financial credit demand to interest rate levels has increased since 2013. What does this mean for policy? The ECB cannot force lending to bolster the credit-and-investment growth cycle, but it needs to preserve supportive lending conditions. We come back to the same conclusion: with QE bound to end next year, we believe the next step for the ECB will be to strengthen forward guidance to emphasise the ‘lower for longer’ rates environment.

Meanwhile in the economy…

In our weekly view, we explain why the September ECB minutes raised our eyebrows. The trade-off between pace and quantity of QE is not trivial and has been discussed. The ECB takes comfort in the current bond market, though we would argue this could be challenged. Opting for EUR 20bn per month for nine months could lead markets to believe that QE could end in September 2018, with implications to rate hike expectations. Meanwhile, data supports our view that the economy grows above potential but a tad softer than in 1H17. Our GDP tracker remains at 0.46% in 3Q 2017(we forecast 0.5% qoq). Better sentiment data now suggests that 4Q’s momentum could be similar.

A (rather difficult) UK picture book

Our regular UK chartpack exercise makes for difficult reading. There are bright spots of course, employment being one of them. But we are tracking 0.2% qoq growth in 2H 2017, see weakness in the consumer, new signs of investment under pressure and a BoE turning hawkish. The glue that holds all this together is the UK’s likely weak trend growth: we have pegged it around 1-1.5% for a while now. The BoE is likely going to make that a reality. We cut our 2018 growth forecast to 1.0% from 1.2% and continue to expect inflation to drop below the BoE’s target next year.