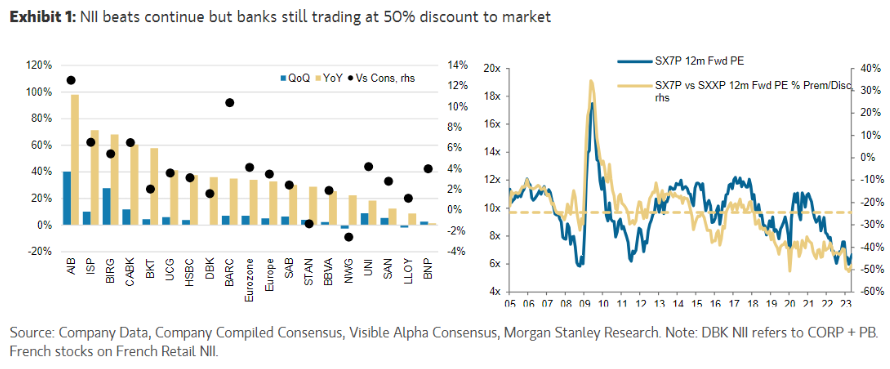

Morgan Stanley: 100% of the sector has beaten NII so far, still a clear buy. Álvaro Serrano (analyst) highlights another quarter of solid results from European banks with 100% beating NII (rising rates and lower deposit betas) and contained credit risk.

That said, the good results and the lack of growth in RWAs allowed banks to boost shareholder distributions with several of them (CABK, DBK, HSBC, BARC…) announcing new buyback programmes. As a consequence, the market reaction to the announcements has been generally positive.

CONCLUSION: After the good results and although the sector has risen 12% in the last 2M, Álvaro reiterates that the European banks trade still has room to run as at 7x P/E it still trades at a 50% discount to the market and offers a double digit total return and the bottom of the PMIs is a key catalyst to maintain the good relative performance.