One of the best gauges of the eurozone’s economic recovery is corporate credit, which is also important in order to measure the volumen of TLTROs that the banking sector will have access to in the coming months. Analysts at Santander believe news are increasingly positive in that sense.

According to data published by the ECB on Friday, the contraction of bank lending to firms in the eurozone has slowed down with a year on year drop of -3.2% in June (-0.1% m/m), i.e. 2 tenths less than in May and 1.2pp below that -4.4% registered in 2013.

Besides, Germany has barely registered any credit lending reduction (0% m/m and – 0.2% y/y), while in France and Italy, there has been a monthly credit growth of + 0.7% m/m and +0.6% m/m, respectively, which means that in a year on year level it’s already of + 0% and – 1.8%, respectively.

In Spain, the collapse of the credit lending stays at -11.4% y/y, i.e., below the -14.1% in 2013, although in still high levels relative to the average of the EZ.

Santander analysts point out that despite the recent sales of interest rates on loans to corporates (especially in SMEs) in the periphery are still quite high in core countries: 4.6% in peripheral banks, i.e. 160pb above 3.0% applied by core banks.

Germany’s challenge

But the banking union’s proposal could face some problems in Germany after 5 academics have filed a lawsuit to the German Constitutional Court challenging the union under the German legislation. Even though the Constitutional Court has shown some support to European banking integration on other occasions, there are fears that this time both the ECB and the EC will have to work further on defending the union.

Banking Union will launch in November when the ECB becomes the only European supervisor after the stress tests, which will be followed by the recapitalization of the sector (through private capital or, ultimately, a 8% haircut of theit balance sheets – equity and unsecured debt, through the SRM) within 6-9 months.

Banks under the spotlight

ECB’s Mario Draghi stated that in order to ensure the sector’s credibility, several entities will have to be suspended. Markets begin to point out to lenders with the highest level of level 3 assets (illiquid ABSs, CDOs, repos and derivatives which, at the end of 2013 amounted to €109.3 billion in the 10 largest banks in the eurozone with a total assets of €11.6tr).

Deutsche Bank or BNP Paribas, according to Santander team’s calculations, are also those who have less total capital (smaller protection mattresses below senior debt) and face greater volatility and new litigation risks.

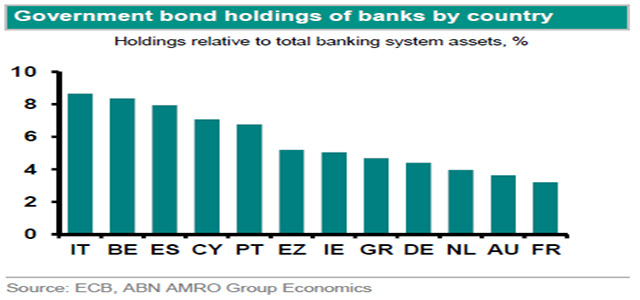

Be the first to comment on "EU banks reach debt holdings all-time high"