European equities have re-rated: even after the recent pullback they trade on 15.2x forward earnings, above long run averages of 14x.

We see three supports for profits:

(1) the biggest FX tailwind for close to 20 years,

(2) an improving macro backdrop and

(3) strong operational leverage to a better top line.

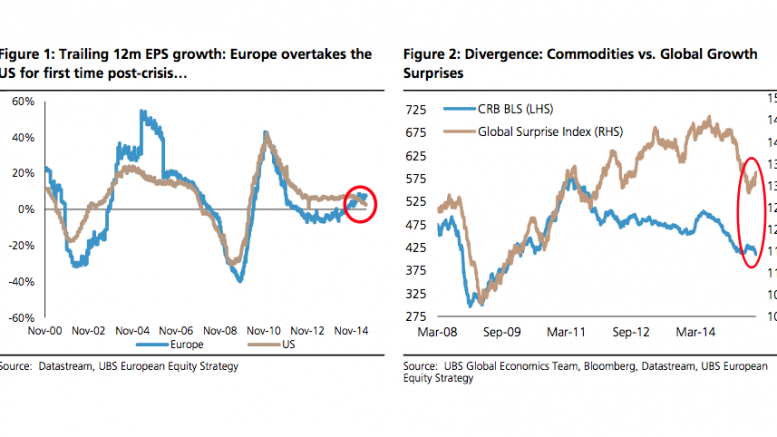

The good news is there are signs of this now coming through: 12m trailing EPS growth in Europe has picked up to the highest in 4 years and is now above the US for the first time since the crisis. The Banks are key to both the recovery in the economy (through the credit cycle) and corporate profits. They are set to provide well over 100% of the European earnings growth for 2015.