Deutsche Bank : The recent credit event in the US banking sector has caused considerable uncertainty about the outlook for policy rates. However, financial authorities have reacted strongly. In addition, the US labour market remains solid and inflation is becoming entrenched. In our view, this continues to justify a “higher for longer” official rate outlook. Although two-year US Treasury yields are falling from their cycle high, they remain, along with ten-year yields, close to their recent highs. The possibility that the US economy will remain robust for longer than expected should keep these yields at elevated levels.

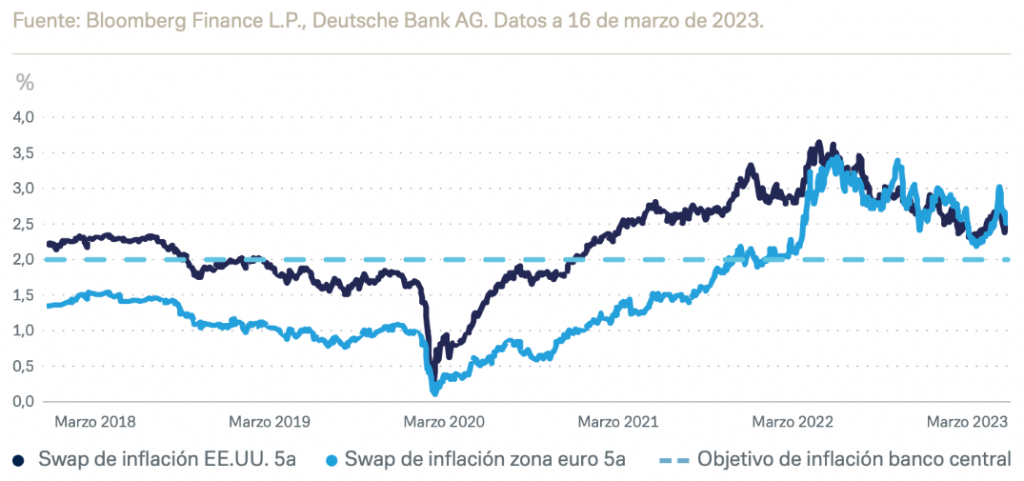

The downward trend in inflation expectations in the last quarter has turned around in view of this year’s high inflation data. Although recent market turbulence has already partially reversed this development, further increases are expected to be limited, as inflation is unlikely to return to previous peaks. Consequently, if nominal yields rise further, this should also push real yields higher.

As the magnitude of the energy crisis has moderated, European activity data have shown signs of an improving economic outlook. At the same time, inflation is expected to remain well below the ECB’s 2% target for an extended period. Therefore, the ECB is expected to raise the deposit rate to even higher levels than the 3.25% reached during the 2008 financial crisis. This should keep the ten-year Bund yields at elevated levels. Italian and Spanish ten-year bond spreads vis-à-vis the Bund are expected to widen somewhat as reinvestments from the ECB’s asset purchase programme are reduced.