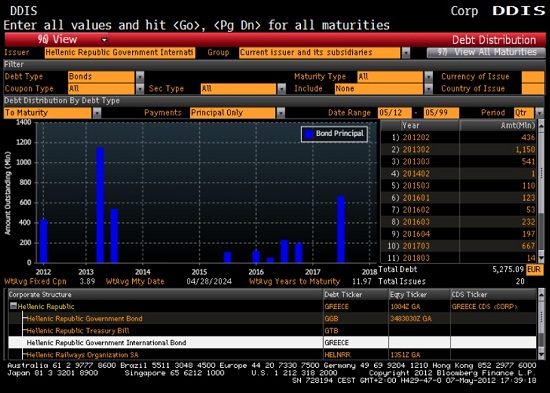

LONDON/MADRID | On May 15, Greece faces a €436-million bill in maturities of State bonds issued under international law. Will the Hellenic Treasury pay investors back? In Madrid, Afi analysts told clients the probabilities of defaulting in some of the bonds that did not participate in the last debt restructuring deal are extremely high. They mentioned as one the causes the current complexity of Greek politics after an election result that has given no clear winner.

The real test will be in June next year, though, when the bill of bond maturities will reach a little over €1.6 billion.

In London, Ryan Hughes, portfolio manager at Skandia Investment Group, felt somehow more philosophic, quoting Aristotle to introduce his view on the Greek debt challenge for both the euro and the capital markets.

“When over 2000 years ago the great ancient Greek philosopher Aristotle wrote ‘the structure of the best tragedy should be not simple but complex and one that represents incidents arousing fear and pity’, little did he know that he would be describing events in his country today,” Hughes said in a note on Tuesday.

The Skandia analyst described the mood in the City, after the weekend’s election results, as full of

“‘fear’ and ‘pity’ are observable in equal measure. Fear from the Greek people knowing that the Far Right Golden Dawn Party now has 21 MPs and the KKE Communist Party has 26 MPs, giving extremist views a strong platform. And pity from across the world as people try to comprehend the pain the people of Greece are suffering as this Greek tragedy lurches on.”

The truth is that the Greek finances remain in a terrible state with a very real prospect that the country will run out of money in the summer. The Greek stockmarket continues to spiral downwards, having falling a further 10% post the election results. In Hughes’ opinion,

“with the pro-bailout parties failing to agree a coalition, it falls to the anti-bailout parties to try and form some sort of government. While this significantly increases the chances of Greece leaving the euro, this looks premature, with many Greeks still believing that a future out of the euro is more painful than remaining in it.”

Be the first to comment on "Greece and the bond maturity guillotine"