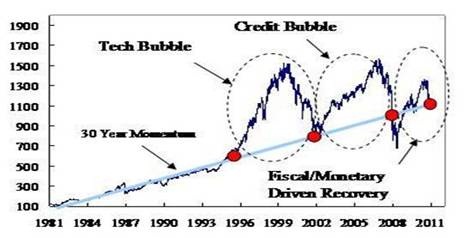

According to JP Morgan, taking the last 30 years, it appears evident that the S&P500 has an average annual return of 7.5%, which makes sense considering an average annual inflation of 3.5% coupled with an average GDP increase of 3% (as an average of the cycles), plus a modest risk premium added.

“The greatest deviations in the last 30 years from this trend occurred during the tech bubble and the credit bubble, as you can see here.

“After the two bubbles there was a return to the trend line.

“Recently we have had in the 2010/2011 another upward deviation, caused by tax/monetary incentives implemented after the credit bubble. Now, dragged by the European debt crisis, we are back to that 30-year trend line.

“For a long-term investor, this should be important.”

Be the first to comment on "JP Morgan to long-term investor: stock markets return to 30-year trend line"