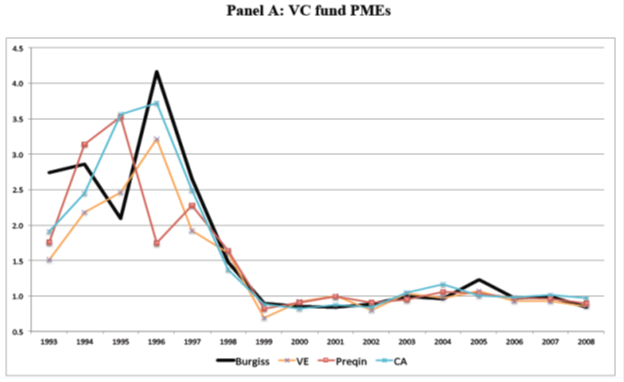

By Luis Arroyo, in Madrid | Please, bear with me. First, I took a graph from the Noah Smith’s blog, in which everyone can see that venture capital has almost passed away since the 2000 crisis. The chart shows the value of equity shares, and each line is a selection made under a different approach.

The 1990’s were the golden age of risk, people loved risk and the VC funding left a legacy of new products and new technologies and new production methods that led to a period of genuine creative destruction, a flurry of changes that increased employment. You can not exactly measure it, but I think it is easy to see the correlation with an era of macroeconomic stability, low inflation and an unemployment rate lower than 4%. The chart says, unfortunately, that this wave of optimism that swept the world ended in 2000 (that is, before the crisis of 2008). This is something that is not often taken into account when speaking of the cycle, but I believe explains the slow exit from the pit we now see ourselves in.

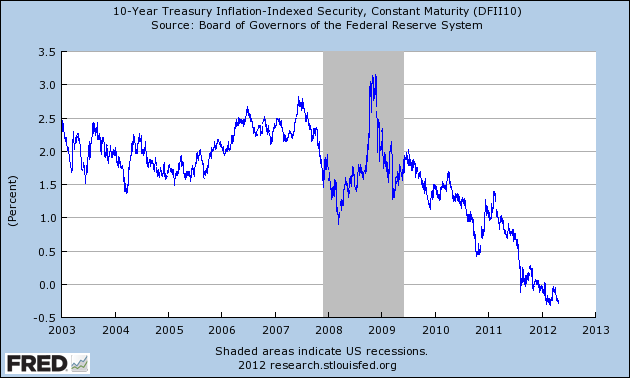

Now, find below a constantly updated graph, which measures risk appetite in general (and we see that for innovation things aren’t looking well). In it, real interest rate (deflated of inflation) on Treasury bonds (blue line) is negative, what means that people prefer to pay money to have these bonds instead of holding any risk at all. By the way, this risk appetite relentlessly goes down and down …

Economics is the art of giving recipes and more recipes until things go well for themselves despite the recipes.

Are these two images related? It is difficult to deny. This suggests another type of cycle, a longer and more complex one than what we have convinced ourselves we are dealing with. What we have before our eyes is an investment cycle compounded by a financial crisis, compounded in turn by a strange alien called euro (does anyone remember the movie?)

No one asks to return the exuberance of the nineties, please. In fact, until normalcy returns to the real interest rate on this US bond (that is, for yields at least to be positive), we will have no stability, no normalcy, no future.

I would say Edmund Phepls is absolutely right here

“The Keynesians, sad to say, show no understanding of how the economy works. They think they can lever employment up or down by pushing buttons –as if the economy were hydraulic. They show no grasp of the concepts that would be necessary to restore us to prosperity and flourishing. In an old image that applies well to the posturing of today’s self-styled Keynesians, ‘the Emperor has no clothes’.”

That is not to say now that the ECB should not become involved in a monetary expansion move before we die of suffocation, but the solution is not sufficient, it is necessary but not sufficient to recover the sort confidence we had in the future.

Be the first to comment on "Lack of appetite for risk"