We believe that in the long term, the winners will be the banks able to deliver smart operational efficiency. This revolves around having the IT, infrastructure and organisational set-up to continue to grow and service clients in the digital age when scale, big data analytics and flexibility matter more than ever.

We believe the winners will be at two extremes – large organizations, big banks in big markets which have already bought into the technology revolution after making reasonable IT investments, and ‘challenger’ banks that do not carry legacy systems but are using their competitive IT advantage to rapidly gain market share. The relative losers, we believe, are the banks in the golden middle – carrying legacy systems, complicated organisational structures, subscale but without appetite/ability to spend to upgrade. Institutions where efficiency gains via traditional routes (cut branches, cut employees) lead to a vicious cycle of losing customers, lower revenues and profits. And then pressure to cut more.

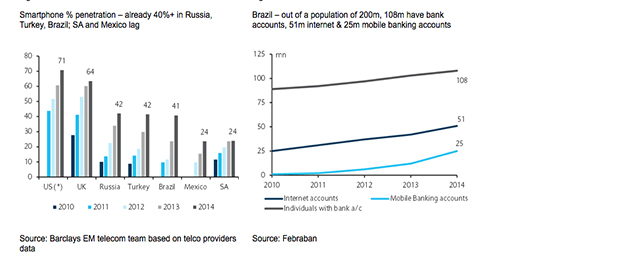

Mobile banking is picking up speed. The ‘techies’ have adopted mobile banking – Turkey, Poland, Brazil and to some extent Russia; while Mexico, SA and Czech are lagging behind. With a number of banks reaching 1m+ digital customers, there is scale, as well as a sense of urgency, due to fast changing customer behaviour and disruptive new entrants.

Cutting staff, cutting branches. Branch networks have adjusted in the economies most hit by the crisis (Greece, Romania) and cuts will likely accelerate in Russia too. Elsewhere we see a stable network for now, while banks are experimenting with more efficient alternative channels such as minibranches, ATMs, correspondent agents, to reduce transaction unit costs. Since 2012, employment levels are down 3% in LatAm, but up 10% in EEMEA.

Be the first to comment on "Mobiles vs Branches: The future for EM banks distribution"