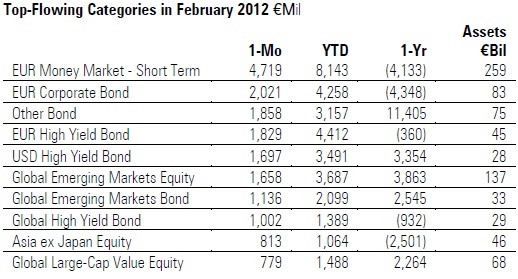

LONDON | Morningstar Europe reported Tuesday that February update showed net positive inflows, with investors adding more than €15 billion in new assets to long-term European-domiciled funds. Fixed-income funds attracted the vast majority of investor cash, with some €12.5 billion in inflows, the asset class’ highest inflow figure since August 2010.

Equity funds saw a modest outflow of investor capital, while money market funds lost €13 billion.

Morningstar research said that funds focused on corporate debt dominated bond fund inflows, with funds in the Morningstar Euro Corporate Bond category seeing the greatest inflows, followed by several high-yield categories. Pimco, M&G, and AllianceBernstein were all big beneficiaries of inflows to bond funds. Fixed-term bond funds sold in Italy saw large inflows.

Dan Lefkovitz from Morningstar’s European team commented:

“After sending money into funds of all types in January, European investors were more selective in February. Whilst equity funds saw outflows, fixed-income funds saw their strongest inflows since August 2010, led by corporate debt offerings. Investors are clearly hungry for yield and consider corporate balance sheets to be healthier than those of Western governments.”

Be the first to comment on "Morningstar Europe reports investors’ comeback to corporate debt"