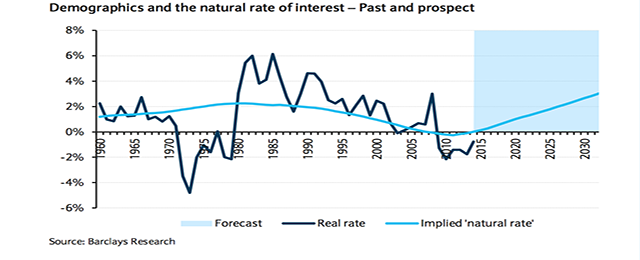

History suggests that the demographic factors upon which we focus have had a powerful effect on the ‘natural’ rate of real interest. Declining support for saving (as the large post-war generation moved through its less productive, early years) led to an increase in our estimate of the ‘natural rate’ into the early 1980s, from about 1.5% in the 1960s to slightly above 2% in the early 1980s. After that, the ‘natural rate’ fell steadily, in response to the ‘savings glut’ associated with the movement of that post-war generation into its most productive, high-saving years, to just below zero in 2010-12.

The actual interest rate has, of course, frequently departed from the ‘natural’ or ‘cyclically neutral’ rate of interest. Some of these departures now look like clear mistakes (eg, the long period of accommodative monetary policy in the late 1960s and 1970s that led to the subsequent acceleration of inflation). In other cases, the departure is clearly explained by monetary policy imperatives, such as the tight money required to stabilize inflation in the 1980s, and recently very expansionary monetary policy associated with the desire to promote recovery from the 2008-09 recession and restore inflation to targeted levels.

We estimate that the demographic inflection point that the world is now facing will have a large effect on the natural rate in the years ahead. We estimate that the natural real interest rate will rise from roughly zero today to about 1% in five years and 2% in 10 years, after which it will continue to face upward pressure as demographic support for savings and asset prices continues to decline.

Be the first to comment on "The natural rate of interest – Past and prospective"