September has arrived and, with it, full political agendas for European leaders. Efforts will focus on stabilizing tensions in the euro area, both at a fiscal and bank level. However, this is no easy task. The high degree of heterogeneity between the different countries of the Monetary Union makes it difficult to implement effective policies that satisfy most of the European partners.

The latest public debt figures for the first quarter of the year reflect this divergence between euro area countries. The public debt of the euro area as a whole represents 88.2% of its gross domestic product (GDP).

This level is relatively comfortable when compared with other developed countries such as the United States and Japan, whose public debt at the end of 2011 stood at 102.8% and 229.9% of GDP respectively. However, the differences between member states of the euro area are significant.

In particular, in the first quarter of the year the public debt of Finland and the Netherlands reached 48.7% and 66.8% of their GDP respectively. In the same order, the public debt for Germany and France stood at 81.6% and 89.2% of GDP, although with visibly different trends. German debt remained almost constant while French debt rose by 3.2 percentage points compared with 2011 and passed the target debt figure established for the year as a whole.

For their part, in Greece, Italy, Portugal, Ireland and Belgium public indebtedness exceeds their gross domestic product.

In the Spanish case, the public debt ratio reached 72.1% of GDP in the first quarter of the year. A level that, although comparatively small, is expected to grow dramatically throughout 2012. The approval of a package of state aid to the banking sector, which will probably total around 60 billion euros, is one of the main factors behind this rise.

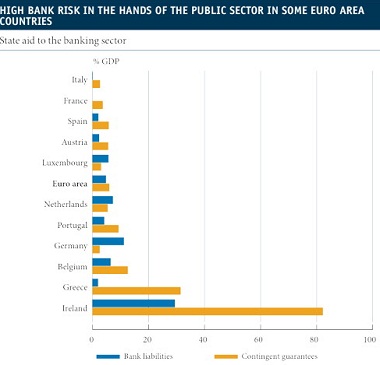

In this respect, since the financial crisis erupted, the relationship between sovereign risk and bank risk in euro area countries has intensified considerably. As can be seen in the graph above, bank liabilities in the hands of the public sector account for 4.1% of the euro area’s GDP.

If we also include contingent guarantees; i.e. coverage by the public sector of part of the banking system’s debts in the case of failure, this figure rises to 11.0% of GDP. Once again, the differences between countries are large. For example, Ireland’s public sector aid to its financial sector has pushed up the country’s public debt by 29.5 percentage points, compared with the almost zero impact this has had in countries such as Italy and France.

Within this context, it is crucial to break the relationship between bank and sovereign risk and, to this end, it is vital to create a European supervisory and regulatory system. In this respect, the European Council meeting in September has generated a lot of anticipation as it is expected to provide some details on the specific.

Be the first to comment on "Public sector and governance: September crucial for the euro area’s future"