BARCLAYS | We have pursued two apparently unrelated topics in our recent research. One topic has been the identification of fundamental traits that have the best track record of making stocks outperform. Some of these are counterintuitive. For example, the stocks of companies with high profit margins have underperformed the stocks of companies with low profit margins over the past 15 years (see Fundamental Factors – Which have worked best ). Alternatively, the stocks of companies that reduce the number of people they employ perform significantly better than the stocks of companies that add employees (see Time to Hire? ). Another topic of our research has been the state of the financing markets. Issuance of IPOs and high yield bonds has collapsed (see IPOs – Another sign the business cycle is over and High Yield – not a concern for the S&P 500 ). This report marries these two topics.

As mentioned, we seek to find fundamental traits that make stocks outperform. One that does particularly well relates to reliance on external financing. Companies that utilize a lot of external financing perform significantly worse than companies that do not require external financing. We measure this through the cash flow statement. Specifically, we use the line item ‘cash flow from financing activities.’ Our analysis shows that the stocks of companies that have a low ratio of cash flow from financing activities-to-market capitalization have outperformed both the S&P 500 and the stocks of companies that have a high ratio of cash flow from financing activities-to-market capitalization. Considering that the financing markets have become more constrained, we believe the environment is right for these stocks to continue to work. Therefore, we recommend buying companies that do not need external financing.

To reflect our preference for companies that do not rely on external financing we provide a list that was derived from quintile one of our proposed strategy. In other words, the 81 companies in the S&P 500 with the lowest ratio of cash flow from financing activities-to-market capitalization, excluding financials. We narrowed the list from 81 to 30 using a random number generator. Examples of companies on the list are Emerson Electric, Humana, Western Union, Illinois Tool Works, and IBM.

Why now ?

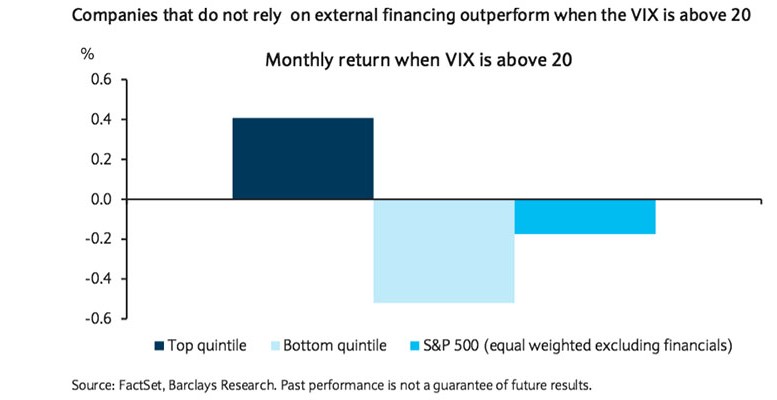

We believe the environment is right for companies that do not rely on external financing to continue to outperform. This is supported by performance during previous periods when volatility was elevated. The level of volatility, as measured by the VIX, is a good proxy for financing conditions because issuance volumes typically decline when the VIX is above 20. Figure above shows the performance of our strategy based on cash flow from financing activities in months when the VIX was above 20. There were 63 months since 2002. During these times, companies with a low ratio of cash flow from financing activities-to-market capitalization (top quintile) outperformed the S&P 500 while companies with a high ratio of cash flow from financing activities-to- market capitalization (bottom quintile) underperformed the S&P 500.