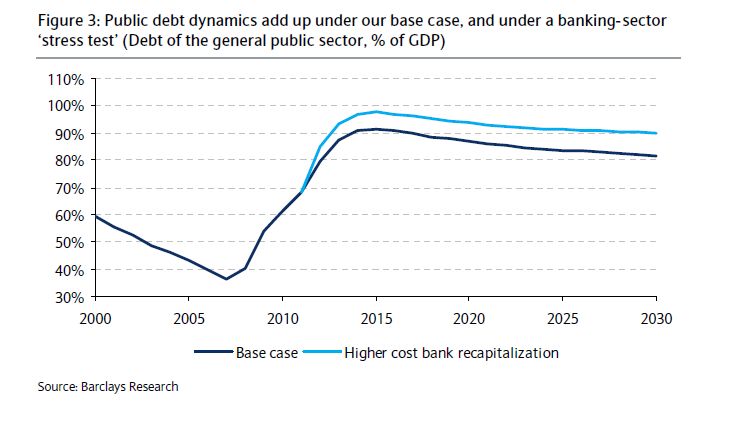

MADRID | Barclays Capital made a realistic yet not Armageddon-like exercise in which the Spanish banking sector would need a recapitalisation equivalent to 6 percent of the country’s GDP, plus an additional 5.4 percent of GDP as an extra-safety calculation. Its analysts threw in 0.9 percent of GDP in Greek liabilities, and 3.5 percent of GDP in administrations’ accumulated debt payments. The scenario considered included yields on 10-year bonds of 6 percent, a budget adjustment of 8 percent until 2015 (of which 2.8 percent has been offset already) and an expected GDP of -2 percent for 2012, -0.5 percent for 2013, and growth in 2014 by 1.75 percent with 2 percent inflation.

The report, published on Friday, said that in the short term Spain’s debt would reach almost 100 percent of GDP but would fall afterwards. The trick is to achieve a budget surplus of 2,25 percent, which has been obtained in the past.

Unfortunately, Barclays Capital admits these numbers would not necessarily calm the financial markets. In their analysts’ opinion, the main problem Spain faces right now is confidence. Spain needs no help to solve the imbalances in its economy, but has so far failed to convince investors and eliminate the anxiety that dries up the tap of foreign financing.

Be the first to comment on "Barclays Capital: Spain’s debt dynamics sustainable"