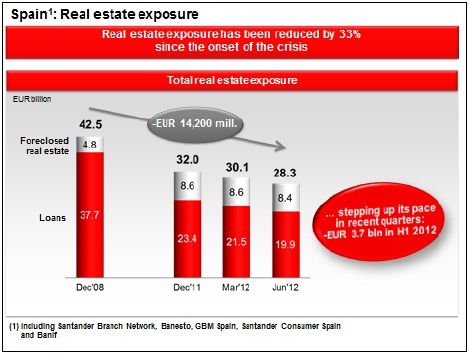

MADRID | Banco Santander announced Thursday a net attributable profit of €1.704 billion in the first half of the year. The figure brings a cut down of about 51% compared with the same period in 2011. The Spanish bank pointed out that the decline is a result of setting aside €1.304 billion for provisions for real estate exposure in Spain of the second quarter ordinary profit of €1.404 billion. As a consequence, there was an accounting profit of just €100 million for the quarter.

Commenting on the results, the chairman of Banco Santander, Emilio Botín, emphasised that the entity is facing upfront the challenges of its real estate risk in the domestic market.

“The first half results […] show we are able to increase revenues and keep costs under control even in a difficult environment. The provisions we are making will allow us to put real estate write-offs in Spain behind us by the end of this year.”

In the first half of 2012, Banco Santander’s group reported that revenues rose 5.3% to €22.544 billion and absorbed costs of €10.041 billion, up 5.1% compared with the same period last year. Latin America and Continental Europe produced strong revenue growth and the performance in Spain stood out. The Santander branch network achieved revenues of €1.217 billion between April and June, the highest figure of the last ten quarters.

Net operating income reached €12.503 billion, 5.5% more than the same period last year and 10.2% more than the second half of 2011. The performance of revenues and costs resulted in an improvement of 20 basis points in the efficiency ratio to 44.5%, the highest among international banks.

Santander said it had allocated €6.54 billion (+42%) to provisions for non-performing loans and a further €1.896 billion (€1.304 billion in net terms) assigned to cover real estate exposure in Spain. The bank also assigned €884 million from the sale of the Colombian business to real estate provisions. The non performing loan coverage ratio rose for the second quarter running, both for the group and the Spanish business, whose coverage ratios were 65% and 53%, respectively.

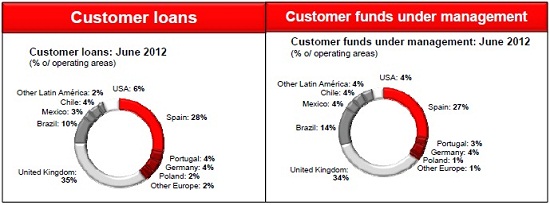

Latin America contributes 50% of Santander’s profits (Brazil makes up 26%, Mexico 12% and Chile 6%). Continental Europe accounts for 27%, of which Spain represents 14%, while the UK brings in 13% and the US 10%.

Be the first to comment on "Spanish real estate exposure halves Santander profits"