Spain feels overwhelmed, to say the least, about the fact that it is these days referred to in countless headlines, euro zone leaders’ comments and foreign market participant analyses. The view from Madrid is that those portraits do not always mix the most accurate data with the intention of extracting a sentenced-to-bailout picture, in most cases.

Of course, this is a biased impression, although the Spanish government and the financial industry in Madrid are not alone in thinking so.

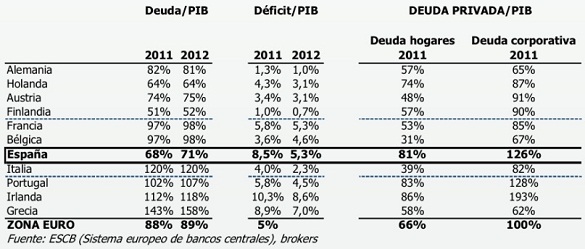

The debate about the size of the public debt to GDP of Spain is a particularly hot subject, anyway. Inversis Banco experts decided to weigh in on Monday:

“Is Spain’s public indebtedness levels higher than what official statistics point out? According to the European Commission’s figures, our public debt to GDP in 2011 was 68.5pc, but some analysts raise this up to 82-90pc, including unpaid bills and public companies’ debt. The truth, though, is that these new numbers come from a varied range of combinations and sum of different debts, there is no homogeneity.

Yet, even accepting them as correct, the Spanish figure would be under the European average of 90.4pc, and very close to Germany’s 88.9pc and France’s 85pc and better than Belgium.”

Be the first to comment on "So you want to talk about Spain’s indebtedness"