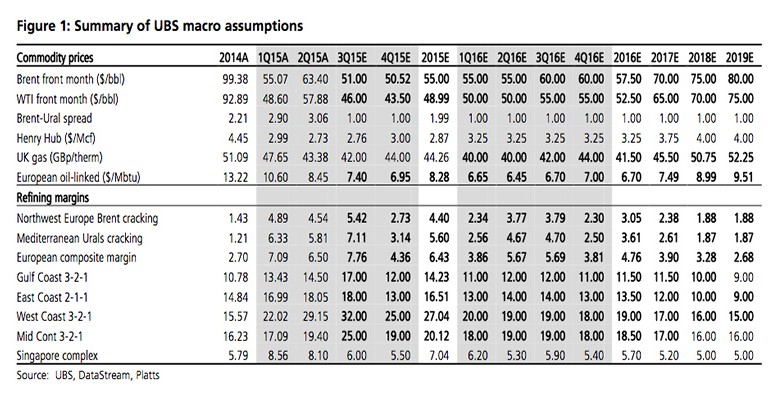

Near term recovery is expected to be stymied by continuing production surplus, the prospects of returning Iranian crude, likely tightening in the US and a China slowdown. “Our cut to normalised reflects expectations of higher US production pushing the supply curve to the right & cost reduction & deflation continuing to work their way through”, explain the experts.

Refining margins expected to hold up longer. Natgas largely unchanged

Refining margins will come off their 1H highs; however it now looks like a combination of the lower crude price and a clear reduction in new capacity adds implies better conditions than we had previously expected.

According to UBS, “we have made no change to US natgas but reduced European natgas forecasts to reflect the lower crude oil prices and the interaction with legacy oil indexed contracts and LNG”.

Earnings cut by an average 15% 2015-19E. Target prices cut by an average 9%

Earnings cuts are material across the sector, cashflow changes are less so – explaining lower PT cuts. The prospect of ‘lower for longer’ is prompting very serious investment and cost cutting across the industry. “We forecast 2017 cash neutrality at $70/bbl, down from $110/bbl in 2015. We see the industry in a cost management and returns focus as much more convincing than in full scale investment mode”, concludes UBS’ analysts.

Valuations don’t reflect new cost focus climate. Upgrading BP to Buy (PT 420p)

We see valuations reflecting new low oil prices but historic cost bases. We believe that managements can address these issues and bring cash back into balance, in which case there is attractive upside. BP looks harshly sold off but very focussed on this issue and hence we upgrade to Buy alongside Shell/BG, Eni, Statoil and GALP.