Spain's external deficit finally came down, but I cannot for the life of me understand why I should feel happy about it. I believe I'm entitled to my scepticism: the truth is that this improvement in money flows has been achieved after vast losses in GDP, employment and investment.

Here you are two charts with which I'd like to explain my timidity. I have compared data from the US and Spain.

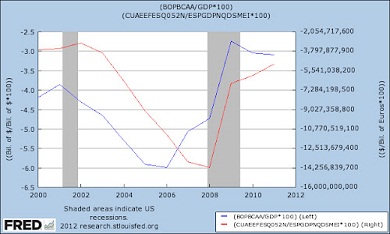

In the first graph, we see the external balance per GDP in both countries. In both cases, there was a problem of excessive external deficit, whose cause coincidentally was the same: ridiculously huge amounts of capital were wasted on bubbles. Both economies have corrected this problem, though, and now show deficits at a sustainable level–3 percent of GDP.

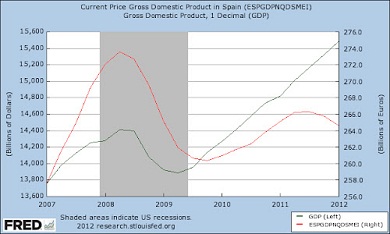

However, when we check their nominal GDP, the stories split. Whereas the US economy has grown (real GDP at 2 percent, nominal GDP at 4 percent), the red line representing Spain unfortunately falls down far from the expansion the Spanish economy could potentially reach. Spain is left with more unemployment and lower capital availability.

This is the result of following two different recipes that are, in fact, opposite to each other: Brussels/Berlin's obsession with increasing savings when income levels are vanishing, versus the right thing to do, the US' effort to recover healthy income levels–avoiding inflation–so debts can be repaid.

The US have their structural reforms done, true. But what has been more important for the downward cycle to be shorter than in Europe is accessing credit at low interest rates. Yes, the US have their own central bank.

On the contrary, Spain has cut its external deficit down due to brutal interest rates that have depressed investment and employment. The government is paying today €10 billion more per year over its debt.

Spain needs credit and foreign investment to grow.