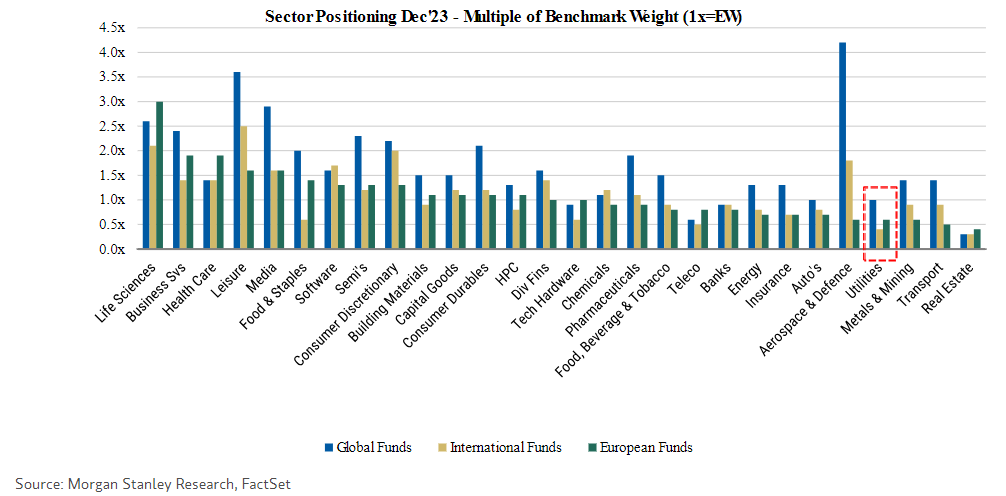

Morgan Stanley| The SX6P has had the worst start in relative terms since 1986 (-10% versus SXXP YTD) as a result of the fall in energy prices. Last week our strategy team published an update of the European sector positioning tracker and one of the conclusions is that Utilities is one of the sectors with the lowest positioning by both European and International Funds. ENEL, National Grid and Iberdrola are among the 35 companies with the lowest positioning in Europe.

In addition, the sector has fallen by -10% in relative YTD for three main reasons:

- Downward revision of EPS estimates as a result of the fall in energy prices.

- Yields are staying higher for longer than initially expected.

- The rotation from Defensives to Cyclicals that we have seen since the beginning of the year.

Since 2010 we have only seen seven previous occasions where the SX6P has fallen -10% vs SXXP in a 2M time frame, and in all of them the sector has rebounded in the following 2M (+9% from min to max). The point is that analysts and derivative strategists see several positives for the sector:

- Analysts have a more constructive outlook on oil and gas demand.

- Positioning levels are very low, leaving plenty of room to add exposure.

- Given the relative YTD performance and consequent derating, the sector has been trading at very low levels, leaving plenty of room to add exposure.

With all this in mind, they have put together a basket of 12 stocks where analysts believe that everything bad is priced in (and that even the fall has been exaggerated) and where they see, on average, a 31% upside (MSSTUT24 basket). Enel, Iberdrola, National grid and EDP are among the most “underowned” European stocks.