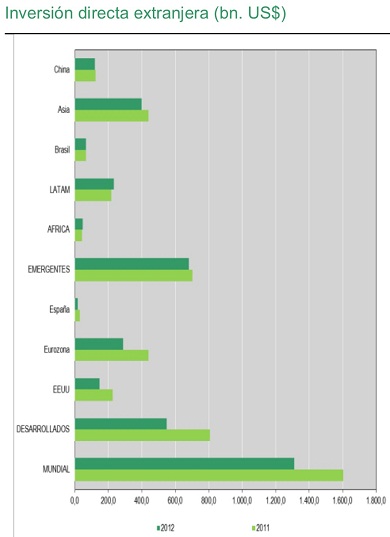

Macroeconomic fragility and policy uncertainty for investors led to an -18.3 per cent decline in global foreign direct investment or FDI inflows last year, to an estimated $1.3 trillion, the United Nations said in a new report. The Global Investment Trends Monitor, published by the UN Conference on Trade and Development (UNCTAD), added that the 2012 figure is close to that of 2009, when FDI flows reached their lowest level of just slightly over $1.2 trillion.

FDI volumes in to the eurozone, nevertheless, were just under $250 billion while in the US figures decreased below the $200 billion mark and in the Latin America region FDI numbers reached slightly over.

Global FDI had started to recover, reaching $1.6 trillion in 2011, according to the agency, which noted that it peaked in 2007, when it was close to $2 trillion. “We thought it was a healthy, steady recovery and now we feel that it will take longer than we expected,” explained James Zhan, director of Investment and Enterprise at UNCTAD. “Our estimate is that in 2013 global FDI may grow by around 7 to 8 per cent and in 2014 something like 17 per cent,” he told a news conference in Geneva. “Having said that, we really feel that the risks are quite strong. Many macroeconomic problems have been contained but not resolved, and they can pop up anytime.”

The report–which covers FDI trends in developed, developing, and transition economies, as well as in major developing regions and recipient countries–states that FDI flows fell “drastically” in developed countries to values last seen almost 10 years ago.

“FDI declined sharply both in Europe and in the United States. In Europe, Belgium and Germany saw large declines in FDI inflows,” UNCTAD pointed out in a news release.

There were a few developed countries that bucked the trend and saw FDI inflows increase, two of them members of the European common currency are, France and Ireland. The other two countries were Canada and the United Kingdom, “although none of these increases were significant in historic terms.”

At the same time, FDI flows to developing economies remained resilient in 2012, reaching $680 billion, the second highest level ever recorded. Developing economies absorbed an unprecedented $130 billion more than developed countries.

FDI inflows to developing nations in Asia fell by 9.5 per cent as a result of declines across most sub-regions and major economies, including China, India, Republic of Korea, Singapore and Turkey.

Be the first to comment on "Eurozone attracted more foreign direct investment than US, LatAm in 2012"