Celebrity economist Paul Krugman recently said he had proof–here and here–that public spending in the US has actually decreased under the Obama administration.

The chart shows public spending per potential GDP, and we can see that public spending has been cut by the states and the federal government once the crisis has begun to abate. The US potential GDP has expanded very slightly, yet the change has been noticeable enough for government spending to shrink by -3%–from 37% to 34%. What would have happened had the country’s GDP stalled or fallen, as in Spain?

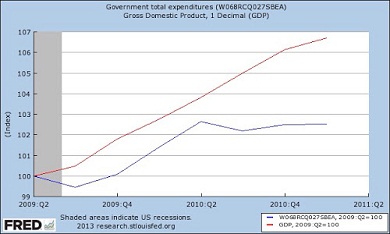

In this graph there can be seen GDP and public spending rates since the lowest point of the recession in June 2009. Spending (the blue line) remains now sort of flat after a 2.5% move upwards while the GDP goes 6.5% up. According to the chart above, the highest spending per potential GDP rate was 36%. Had the GDP stalled, this rate would be now at 37% instead of 34%.

And debt per GDP, at 96%, would have reached 107%. Hopefully, someone in Brussels will sooner than later get the growth conundrum.

Be the first to comment on "Why we need growth now"