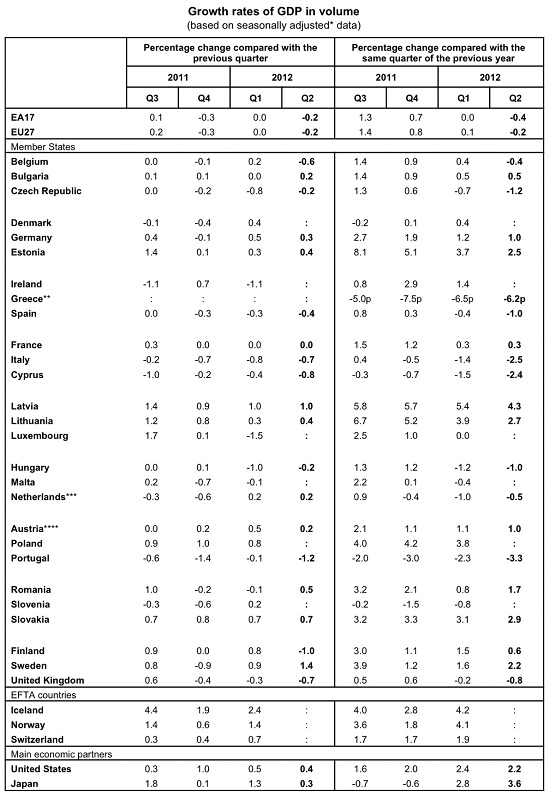

The seemingly dead weight of the peripheral economies continues to mark a divide within the common currency region. The overall picture, unavoidably, registers the cut. GDP fell by 0.2% in both the euro area and the EU during the second quarter of 2012, compared with the previous quarter. Also according to flash estimates published by Eurostat Tuesday, in the first quarter of 2012, growth rates were zero in both zones.

Compared with the same quarter of the previous year, seasonally adjusted GDP fell by 0.4% in the euro area and by 0.2% in the EU in the second quarter of 2012, after 0.0% and +0.1% respectively in the previous quarter.

On the other hand, during the second quarter of 2012, GDP increased by 0.4% in the United States compared with the previous quarter (after +0.5% in the first quarter of 2012) and by 0.3% in Japan (after +1.3%). Compared with the same quarter of the previous year, GDP rose by 2.2% in the United States (after +2.4% in the previous quarter) and by 3.6% in Japan (after +2.8%).

With these fresh data on the table, the markets wonder now how much Germany and France can take before their economies follow the southern suit and allow some radical, quick changes in Brussels’ current counter-crisis policies.

As Azad Zangana, European economist at Schroders, said in a note today,

“Overall, the story of a resilient core and a floundering periphery continues. Very low unemployment and falling inflation in Germany are helping to boost household purchasing power and consumption. Meanwhile, austerity in Italy, Spain and Portugal continues to hit business investment and consumption.

“Looking ahead, the resilience of the core economies is likely to be tested in the coming quarters,” Zangana warned, “with leading indicators suggesting slowing order books and falling businesses confidence. Of course, the outlook remains very uncertain.”

Be the first to comment on "How long until core euro countries hurt?"