According to a report about dividends from Allianz Global Investors, European companies have an investor-friendly dividend policy compared to their international peers. At the end of December 2018, their average dividend yield across all market segments (based on MSCI Europe) was around 3.8 %.

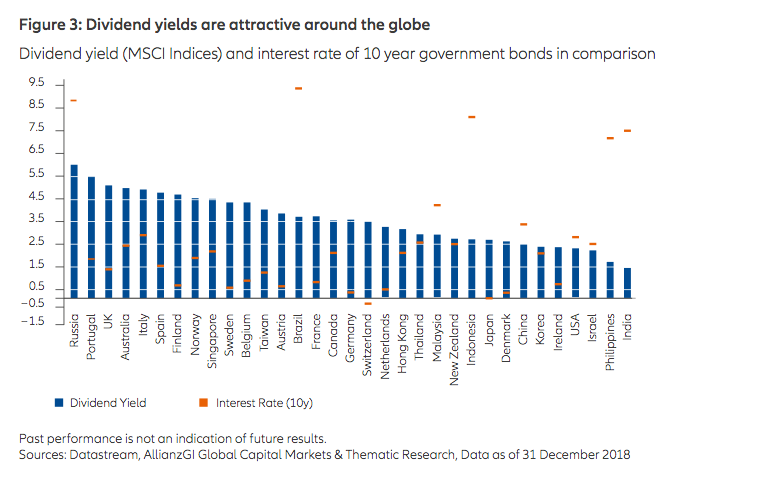

Focusing on high-dividend stocks meant that the expected dividend yield in the portfolio rose even further. However, economists at Allianz Global Investors point that the dividend yield in other regions is considerably higher than that on 10-year government bonds, too. For example, the dividend yield on the MSCI-USA seems positively modest in comparison, although you have to bear in mind that US companies, in contrast to European ones, for instance, have a stronger tendency to launch share buyback schemes than to pay out dividends. Share buyback schemes, though, are nothing other than corporate profits being paid out to a smaller, residual circle of shareholders.

At the same time, what is noticeable is that dividends can potentially help achieve additional stability in the portfolio. As explained by the analysts: I

In the past, investors in European equities were the main beneficiaries of high dividend payouts that also helped in stabilising the overall performance in years of declining stock prices. Dividends were able to partially or even totally compensate for any price losses.

Over the entire period (1973 – 2018), the performance contribution of dividends to the annualised total portfolio return for the MSCI Europe was approximately 41 %. But in other regions, such as North America (MSCI North America) or Asia / Pacific (MSCI Pacific), around a third of overall performance was determined by dividends, albeit the absolute dividend yield was lower here.

However, for Allianz Global Investors, dividends alone cannot ensure more stability with equity investments:

High-dividend equities in themselves seem to have a less volatile performance than those of companies with lower dividend payouts.

This is demonstrated by analysing the past performance of US stocks, for which the longest time series are available. This analysis shows that the volatility of US equities (measured in terms of a 36-month rolling standard deviation as a gauge of price fluctuation) has been lower since 1975 among companies paying out a dividend than among stock corporations that did not distribute any profits. Analogous behaviour is also discernible for European dividend stocks since the 1990s.