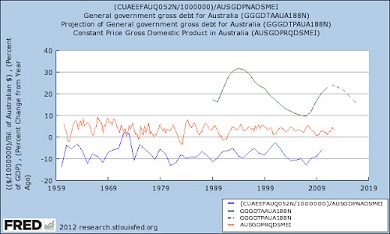

Australia is a peculiar country, indeed. Since 1970, its average current account deficit per GDP stands at about 3 percent–that would be the blue line in the chart above. Never mind: it enjoys higher growth than most developed countries–some 4 percent, the red line–and an enviable unemployment rate of just 5 percent. Inflation slides on the 2 percent mark.

The green line represents its debt per GDP rate, one of the lowest in the world, below 20 percent. And the forecast until 2017 reduces this number even more.

According to those economists who care so much about trade balances, Australia should be ruined. Four decades of deficit would surely be unsustainable. Following the same rule, a balanced current account would bless Spain with economic recovery no matter how much austerity one throws at it.

What happens here is that Australia’s deficit is caused by imports of capital goods to increase its capabilities of extracting minerals and also to expand other industries. As long as its spending plans generate healthy levels of production and enough income to pay dividends and interests, the external deficit will not matter. And when finance comes in the shape of direct investment, the situation is even better.

Spain needs permanent external capital flows, now more than ever. It is a structural factor, which has today turned into an open wound due to the credit crunch, the waste of resources that were available during the bubble years between 2000 and 2007… and due to the lack of control over the exchange rate.

Good economic management involves an apt use of the exchange rate. It sometimes must play its role in the adjustment of accounts. The following chart shows the exchange rate of the US and the Australian dollar–red line–and inflation–green light–, which is contained at about 2.5 percent although it had a more convulsed past. Precisely like in Spain’s case.

But Australia isn’t member of the euro zone.

Be the first to comment on "The answer to the euro’s troubles is down under"