In the trade sphere, Spain’s trade surplus with the UK stands at 1.3% of the former’s GDP in 2014. Furthermore, “and unlike other big economies in the euro area, Spain has a trade surplus in both goods and services with the UK (the latter a result of tourism),” Afi’s experts say.

The UK is the fifth most important destination for exports of goods and services from Spain, accounting for nearly 7% of the total. The UK is also particularly important for the automobile and aviation industries (vehicles as well as engines), the food sector (food and drink) and the pharmaceutical industry.

Brexit may have a negative impact on these trade flows, given that the expectations are for British consumers confidence and purchasing power to decline (the pound’s depreciation). How important the impact might be will finally depend on the kind of bilateral agreement reached between the UK and the EU, as well as the time it takes to conclude the negotiations.

Foreign Direct Investment

The UK is the main destination for Spanish foreign investment, accounting for 15.2% of Spain’s direct foreign investment (DFI) in 2014 (and around 5% of the total DFI in the UK)

For its part, Great Britain is also a significant source of DFI for Spain; UK investment accounts for 11.4% of total DFI (37 billion euros). Furthermore, the UK is Spain’s leading foreign investor in terms of accumulated investment since 1993 (when the historical series began). Its strongest presence is in the tobacco, telecommunications, financial services and retail sectors.

Experts explain that “as is the case for the other EU economies, the uncertainty surrounding the regulatory changes which Brexit might produce could affect the investment flow between the two countries. At the same time, the pound’s depreciation would have a negative impact on the profits of Spanish companies with subsidiaries in the UK.”

Spanish DFI in the UK reached 62 billion euros in 2015, channeled mainly towards the financial (35%), telecommunications (33%) and energy supply sectors (10%).

Financial sector

The Spanish economy is particularly exposed to Britain’s financial sector via Banco Santander and Banco Sabadell (owns TSB).

“It’s estimated that Santander UK holds 10-12% of British current accounts, while TSB has around 5%. In 2015, the UK accounted for 28.6% of Santander’s assets and 30% of net profit. TSB accounted for 20.7% of Sabadell’s assets and 17.2% of its profits,” analysts at Afi remind.

In total, Spanish banks had credit claims against British counterparts worth 412 billion dollars in the third quarter of 2015, just a little behind Germany (417 billion dollars) and the US (447 billion dollars). The majority of these claims correspond to the non-financial sector (for example, consumer or corporate loans). On the other side of the coin, UK financial institutions’ claims against Spanish counterparts are significantly lower (26 billion dollars).

In any case, the fact the Spanish banks just have subsidiaries in the UK should limit the impact of Brexit. Apart from the uncertainty, the pound’s depreciation will have a major impact as it will reduce the amount of profits the banks can repatriate.

On the other hand, Brexit will be a shock for the British economy which could increase the number of defaults, with the consequent effect on banks’ capital.

“We think Spanish banks will have the option to support their UK subsidiaries or not. In the medium term, they will also have to deal with regulatory costs as they adapt to a new regulatory framework”, Afi affirms.

Migrant and tourist flows

This is one of the most important risks for the Spanish economy as UK represents the main market for Spain’s tourism industry: British tourists account for almost 25% of the total number of visitors to Spain. In 2015, Spain received over 15.5 million British tourists who spent 14.057 billion euros, or 20.9% of the total tourist expenditure in Spain (and a figure which represents a 10.3% rise on 2014).

- According to data from the National Statistics Institute, approximately 300,000 British people live permanently in Spain, which makes them the third largest nationality after the Romanians and the Morrocans. The British Embassy has calculated that there are also another half a million British citizens who live in Spain on a temporary basis during some part of the year.

- In the opposite direction, the UK is the main destination for Spanish immigration, taking in 14% of all Spanish immigrants. According to estimations, Spanish immigration to the UK rose 25% in 2014 from a year earlier.

Brexit’s short term impact on tourism will depend on the pound’s depreciation, to the extent that it reduces the British people’s purchasing power. But the relatively low level of prices in Spain (compared to other destinations like France) may partially offset this effect.

Finally, and as far as domestic policy is concerned, Afi says that despite the fact that the UK and Spanish governments have not always been allies in this area, Spanish industry could suffer from resentful over the loss of a liberal member at the heart of the EU.

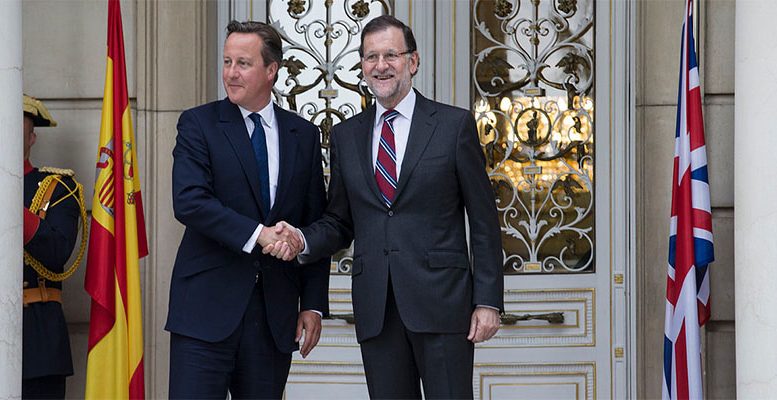

*Image: Flickr / UK in Spain